Mako Mining Corp. (TSX-V: MKO) (“Mako” or the “Company”) is pleased to report positive drill results from the Las Conchitas area of its wholly-owned San Albino-Murra property located in Nueva Segovia, Nicaragua. The Las Conchitas area is located approximately 2.5 kilometers south of the fully permitted San Albino gold project currently under construction.

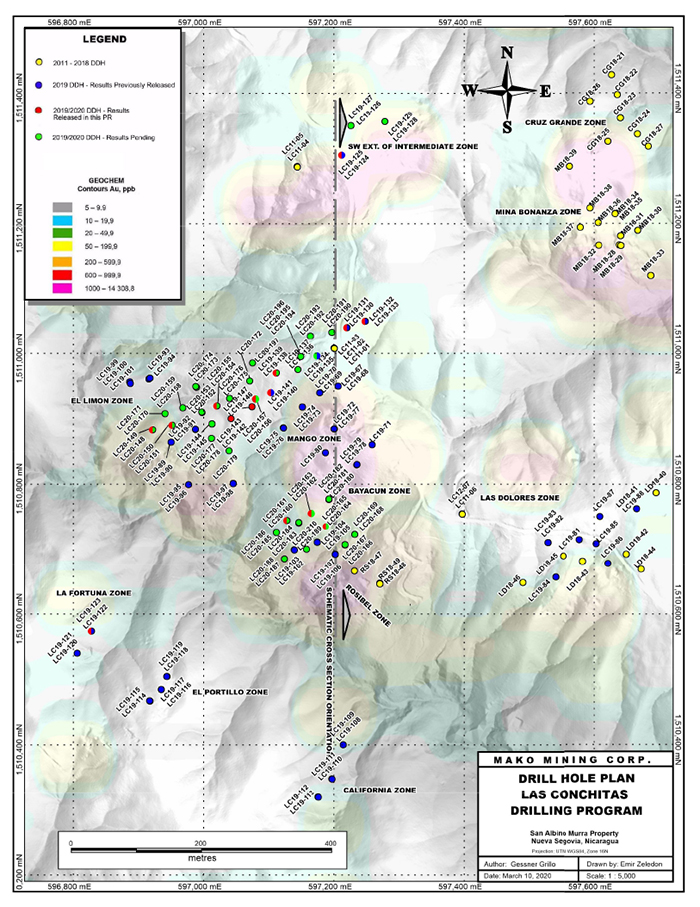

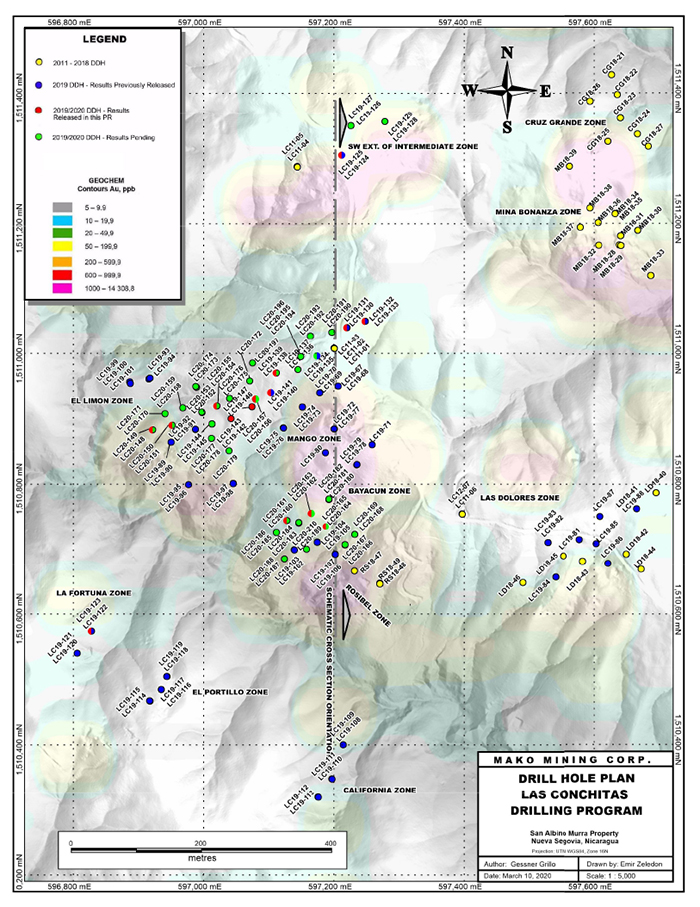

The goal of the 2020 drill program at Las Conchitas is to focus on the most promising zones of near surface, shallow dipping, high-grade gold mineralization in order to delineate a maiden resource. Since 2019, the Company has completed 134 shallow drill holes totaling 10,644.20 meters (“m”) within the Las Conchitas area (see the attached map).

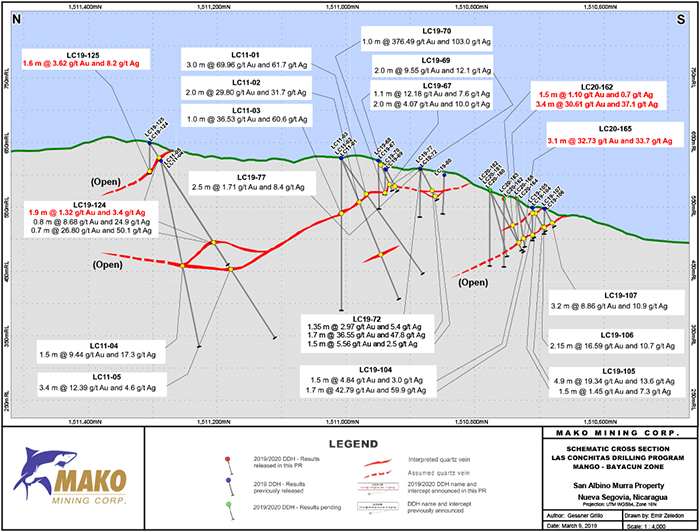

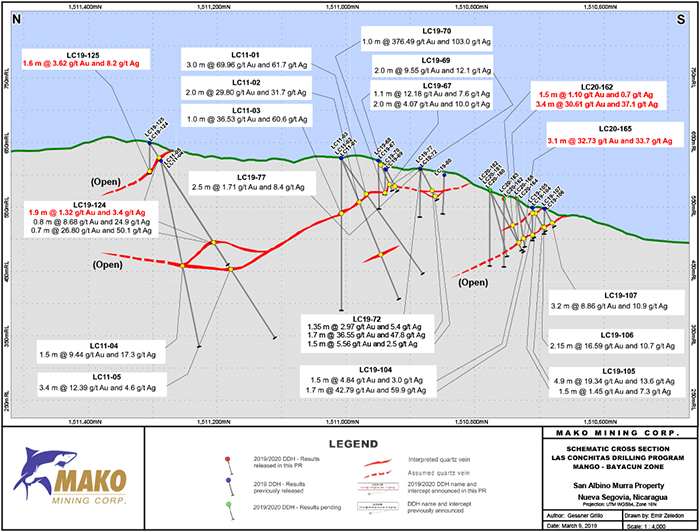

The highest grade intervals reported in this press release come from drill holes LC20-165 and LC20-162. Both holes are located in the Bayacun Zone, which was discovered by Mako in 2019 (see press release dated September 10, 2019), and is located towards the southern end of the Las Conchitas area, approximately 4 kilometers south of the processing plant currently under construction at San Albino.

Hole LC20-165 intersected 32.73 g/t Au and 33.7 g/t Ag over 3.1 m approximately 56 m from surface (see attached cross section). This hole was drilled to test a down-dip extension of high-grade gold mineralization intercepted in hole LC19-104, which returned 42.79 g/t Au and 59.9 g/t Ag over 1.7 m approximately 40 m from surface (see attached cross section and press release dated September 10, 2019). Hole LC20-162 intersected 30.61 g/t Au and 37.1 g/t Ag over 3.4 m approximately 63 m from surface.

Akiba Leisman, Chief Executive Officer of Mako states, “these results at the Bayacun Zone of Las Conchitas further support our thesis that the San Albino deposit is part of a larger high-grade, near surface gold system on the Company’s 150 square kilometer land package. Additionally, we have only begun to understand the geological controls at Las Conchitas. As we continue drilling, and as we gain invaluable information from mining the San Albino deposit to the north, we expect to advance Las Conchitas to the point where it can become our second area of mining over the next couple of years.”

Bayacun is an historic underground mine, which was last operated in the late 1800’s. While no production data is available, the Company had previously sampled what appeared to be a historic stockpile near a tunnel in 2012 that returned 34.90 g/t Au and 42.4 g/t Ag (see press release dated March 21, 2012). Direct shipping ore was sent to the nearby, historic El Golfo mill for processing. The mill, along with the historic El Golfo mine, are located within Mako’s El Jicaro concession, an area which the Company plans to drill after the San Albino gold project is commissioned.

The Bayacun Zone appears to be analogous to San Albino in terms of continuity, geochemistry and predictability. It is open for at least 50 m to the southwest until Candelaria creek, which is interpreted to be a fault with unknown offset. The zone is also open down-dip and to the northeast. Importantly, recent down-dip drilling at the Bayacun Zone has returned holes containing visible gold. Assays on these holes are expected back later this month.

Furthermore, drill hole LC20-148 returned a mineralized interval of 20.94 g/t Au and 6.13 g/t Ag over 2.3 m, 73 m from surface within the El Limon Zone. This hole was designed to test the down-dip extension of El Limon and results have demonstrated that the high-grade gold mineralization is still open to the southwest.

Las Conchitas is an underexplored area along a gold-rich corridor with multiple historic underground workings. All of the underground workings are caved-in and not accessible. Outcrops in the area are sparse to nonexistent, making it challenging to resolve the structural complexities of the area and to determine the local controls on gold mineralization. The Company is eager to expose the gold bearing veins at San Albino to gain a better understanding of the gold emplacement and to apply this knowledge at Las Conchitas.

This press release contains results from 17 holes totaling 1,668.85 m drilled into five zones. There are 52 additional drill holes still awaiting assay results.

Las Conchitas Assay Results Reported In This Press Release

| Drill Hole |

From

(m) |

To

(m) |

Width

(m)* |

Au

(g/t) |

Ag

(g/t) |

Interval Average / Comments |

Zone |

| LC19-123 |

|

|

|

|

|

No significant results |

La Fortuna |

| LC19-124** |

27.70 |

28.70 |

1.00 |

|

|

Void |

SW

Extension of

Intermediate

Zone |

| 28.70 |

30.60 |

1.90 |

1.32 |

3.4 |

1.32 g/t Au and 3.4 g/t Ag over 1.9m |

| 41.40 |

42.50 |

1.10 |

|

|

Void |

| 199.80 |

200.60 |

0.80 |

8.68*** |

24.9 |

8.68 g/t Au and 24.9 g/t Ag over 0.8m |

| 202.70 |

203.40 |

0.70 |

26.80*** |

50.1 |

26.80 g/t Au and 50.1 g/t Ag over 0.7m |

| LC19-125 |

42.90 |

44.50 |

1.60 |

3.62 |

8.2 |

3.62 g/t Au and 8.2 g/t Ag over 1.6m |

| LC19-126 to 129 |

|

|

|

|

|

Results pending |

| LC19-130** |

0.00 |

1.50 |

1.50 |

1.36 |

3.3 |

1.36 g/t Au and 3.3 g/t Ag over 1.5m |

Mango Zone |

| LC19-131 |

2.50 |

3.50 |

1.00 |

5.44 |

13.2 |

5.44 g/t Au and 13.2 g/t Ag over 1.0m |

| LC19-132** |

96.00 |

97.10 |

1.10 |

3.04*** |

5.1 |

3.04 g/t Au and 5.1 g/t Ag over 1.1m |

| LC19-133 |

|

|

|

|

|

No significant results |

| LC19-134 |

|

|

|

|

|

Results pending |

| LC19-135** |

62.10 |

63.50 |

1.40 |

62.30*** |

70.3 |

62.3 g/t Au and 70.3 g/t Ag over 1.4m |

| LC19-136 |

|

|

|

|

|

Results pending |

| LC19-137 |

|

|

|

|

|

Results pending |

| LC19-138 |

42.15 |

43.15 |

1.00 |

14.50 |

11.2 |

14.5 g/t Au and 11.2 g/t Ag over 1.0m |

| LC19-139 |

|

|

|

|

|

Results pending**** |

| LC19-140 |

68.00 |

68.75 |

0.75 |

2.35 |

5.5 |

2.35 g/t Au and 5.5 g/t Ag over 0.75m |

| 71.70 |

72.60 |

0.90 |

9.67 |

33.9 |

9.67 g/t Au and 33.9 g/t Ag over 0.9m |

| LC19-141** |

27.50 |

28.00 |

0.50 |

5.23*** |

4.1 |

5.23 g/t Au and 4.1 g/t Ag over 0.5m |

| 61.00 |

61.50 |

0.50 |

3.69*** |

4.5 |

3.69 g/t Au and 4.5 g/t Ag over 0.5m |

| 68.20 |

68.90 |

0.70 |

44.71*** |

43.1 |

44.71 g/t Au and 43.1 g/t Ag over 0.7m |

| LC19-142 |

76.20 |

77.30 |

1.10 |

1.33*** |

5.2 |

1.33 g/t Au and 5.2 g/t Ag over 1.1m**** |

El Limon |

| LC19-143 |

79.00 |

80.00 |

1.00 |

1.02*** |

4.2 |

1.02 g/t Au and 4.2 g/t Ag over 1.0m**** |

| LC19-144 to 145 |

|

|

|

|

|

Results pending |

| LC19-146 |

101.20 |

102.40 |

1.20 |

1.12 |

6.9 |

1.12 g/t Au and 6.9 g/t Ag over 1.2m |

| |

105.20 |

106.50 |

1.30 |

1.19 |

1.1 |

1.19 g/t Au and 1.1 g/t Ag over 1.3m |

| LC19-147 |

90.00 |

90.60 |

0.60 |

1.50*** |

2.3 |

9.1 g/t Au and 13.6 g/t Ag over 2.1m |

| 90.60 |

92.10 |

1.50 |

12.14*** |

18.1 |

| LC20-148 |

81.40 |

81.90 |

0.50 |

93.2 |

27.4 |

20.94 g/t Au and 6.13 g/t Ag over 2.3m |

| 81.90 |

82.70 |

0.80 |

0.1 |

0.3 |

| 82.70 |

83.70 |

1.00 |

1.49 |

<0.3 |

| LC20-149 |

|

|

|

|

|

Results pending |

| LC20-150 |

89.50 |

90.50 |

1.00 |

7.71 |

9.8 |

7.71 g/t Au and 9.8 g/t Ag over 1.0m**** |

| LC20-151 to 153 |

|

|

|

|

|

Results pending |

| LC20-154 |

24.50 |

25.10 |

0.60 |

18.20 |

7.4 |

18.2 g/t Au and 7.4 g/t Ag over 0.6m**** |

| LC20-155 |

27.00 |

28.50 |

1.50 |

0.56 |

1.0 |

Results pending**** |

| LC20-156 |

63.00 |

63.50 |

0.50 |

7.55 |

7.6 |

7.55 g/t Au and 7.6 g/t Ag over 0.5m**** |

| LC20-157 to 159 |

|

|

|

|

|

Results pending |

| LC20-160 |

56.50 |

57.50 |

1.00 |

1.936 |

6.8 |

3.34 g/t Au and 4.7 g/t Ag over 3.5m**** |

Bayacun |

| 57.50 |

58.50 |

1.00 |

0.595 |

2.9 |

| 58.50 |

60.00 |

1.50 |

6.095 |

4.6 |

| LC20-161 |

|

|

|

|

|

Results pending**** |

| LC20-162 |

42.00 |

43.50 |

1.50 |

1.10 |

0.7 |

1.1 g/t Au and 0.7 g/t Ag over 1.5m |

| 69.70 |

70.70 |

1.00 |

1.11 |

2.2 |

30.61 g/t Au and 37.1 g/t Ag over 3.4m |

| 70.70 |

71.70 |

1.00 |

62.50 |

88.0 |

| 71.70 |

72.40 |

0.70 |

41.70 |

24.1 |

| 72.40 |

73.10 |

0.70 |

16.10 |

27.3 |

| LC20-163 |

|

|

|

|

|

Results pending |

| LC20-164 |

|

|

|

|

|

Results pending |

| LC20-165 |

60.80 |

61.30 |

0.50 |

13.90 |

79.7 |

32.73 g/t Au and 33.7 g/t Ag over 3.1m |

| 61.30 |

62.60 |

1.30 |

29.90 |

30.0 |

| 62.60 |

63.90 |

1.30 |

42.80 |

19.8 |

| LC20-166 to 196 |

|

|

|

|

|

Results pending**** |

The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 meter of internal dilution. *Lengths are reported as core lengths. True widths vary depending on drill hole dip, the veins are shallow dipping and typical true widths are 80-100% of the downhole width. **Indicates previously released assay results. ***Indicates assays determined using the metallic screening method. ****Only a portion of the hole has been received.

Sampling, Assaying, QA/QC and Data Verification

Drill core was continuously sampled from inception to termination of the drill hole. Sample intervals were typically one meter. Drill core diameter was HQ (6.35 centimeters). Geologic and geotechnical data was captured into a digital database, core was photographed, then one-half split of the core was collected for analysis and one-half was retained in the core library. Samples were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas and pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. Gold was analyzed by standard fire assay fusion, 30 gram aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. Due to the presence of coarse gold, the Company has used 500-gram metallic screened gold assays for analyzing samples from mineralized veins and samples immediately above and below drilled veins. This method, which analyzes a larger sample, can be more precise in high-grade vein systems containing coarse gold. All reported drill results in this press release using the metallic screening method are indicated. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards, and blanks were inserted into the sample stream at a ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data. No top cut has been applied to the reported assay results.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under National Instrument 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration firm. The Company is developing its high-grade San Albino gold project in Nueva Segovia, Nicaragua. Mako’s primary objective is to bring San Albino into production quickly and efficiently, while continuing exploration of prospective targets in Nicaragua.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Statements: Some of the statements contained herein may be considered “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is based on certain expectations and assumptions, including that the results pending from the remaining 52 additional drill holes for which the Company is awaiting results from the laboratory will support strike and dip continuity of gold mineralization; that the Company’s exploration programs will be successfully completed; that a maiden resource at the Mango Zone may be delineated as a result of the Company’s 2020 drilling; and that the Company will be successful in any financing plans necessary for drilling and construction at the San Albino project. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, the risks that additional satisfactory exploration results at the Mango zone will not be obtained; the risk that the Company’s drilling at Las Conchitas in 2020 will not delineate a maiden resource at the Mango Zone; that exploration results will not translate into the discovery of an economically viable deposit; risks and uncertainties relating to political risks involving the Company’s exploration and development of mineral properties interests; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations, the inability or failure to obtain adequate financing on a timely basis and other risks and uncertainties. Such information contained herein represents management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s plans and expectations at its San Albino project and the Las Conchitas area, and may not be appropriate for other purposes.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.