Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) (“Mako” or the “Company”) is pleased to report positive drill results from expansion drilling to the Northeast and Southwest of the current San Albino resource.

A technical report for the updated mineral resource estimate (the “MDA Resource”) was filed in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) under the Company’s SEDAR profile at www.sedar.com and available on the Company’s website at www.makominingcorp.com (see press release dated October 19, 2020).

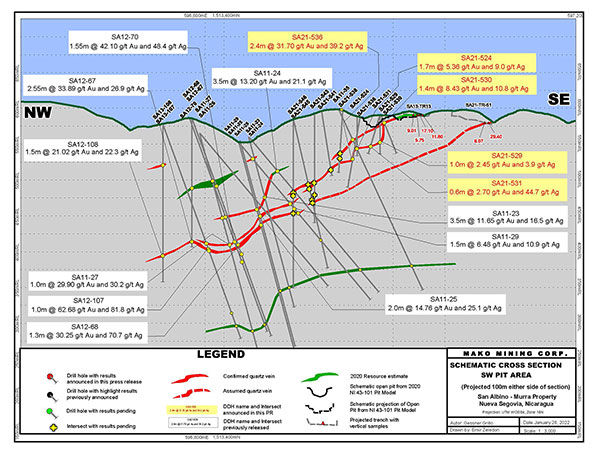

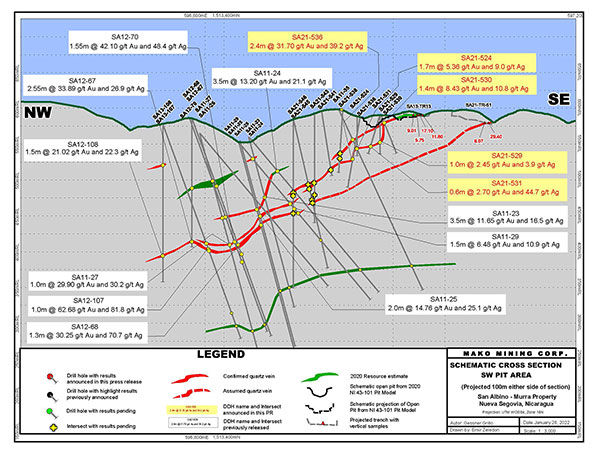

The objective of this drilling is to expand the current open pit mineral resources down dip and along strike at the West Pit, which is currently being mined along with the Central Pit to the east. Additionally, the program was designed to delineate new mineral resources in the Southwest (SW) Pit area. While there have been previous intersections at the SW Pit area from 2011-2013 (see Table 2), at the time of the MDA Resource, there was insufficient data to confidently estimate a significant open pit mineral resource in this zone. This program will lead to a much better understanding of the geological controls at the SW Pit, and management believes that an increase in the mineral resources at both the West Pit and SW Pit areas is likely.

The Company currently has four rigs operational, with two drill rigs dedicated to exploration at the San Albino area, and two rigs dedicated to Las Conchitas to the south. An additional two rigs are scheduled to arrive at site later this week to accelerate the San Albino drilling and plans to increase the total rig count to 8 are underway to allow the commencement of regional drilling at our newly permitted Potrerillos and La Segoviana concessions.

Highlights

- Selected intercepts of shallow high-grade mineralization include:

- 22.20 g/t Au and 23.1 g/t Ag (3.3m estimated true width) in hole SA21-552 at the West Pit approximately 90m outside the current open pit mineral resource.

- 31.70 g/t Au and 39.2 g/t Ag (1.55m estimated true width) in hole SA21-536 at the SW Pit.

- 23 pending holes (14 in the West Pit and 9 in the SW Pit), had detailed geologic logging which indicated that they intersected the mineralized zones as predicted due to the presence of galena and arsenopyrite. Thirteen of these pending holes which intersected mineralization also showed the presence of visible gold.

Akiba Leisman, Chief Executive Officer of Mako states that, “these are exciting results which will likely expand the current mineral resources at San Albino along strike in both directions as well as down dip. When we published the MDA Resource in 2020, we intentionally took a conservative approach to calculating our mineral resources. From 2011-2013, despite 11 intersections of high-grade mineralization in the SW Pit, only a de minimis open pit mineral resource was calculated in this area, as we felt the geological model needed to be refined. Now that we have clear controls over the geology, with numerous pending holes intersecting mineralization where predicted, and usually containing visible gold, we are confident that this drill program will expand the mineral resources at San Albino. We will release new and pending results in due course after we receive them back from the laboratory.”

Specific comments on significant results reported in this press release are as follows:

West Pit

Drill hole SA21-552 intersected a mineralized interval of 22.20 g/t Au and 23.1 g/t Ag over 3.80m (3.3m estimated true width). This intercept is located approximately 90m outside the current open pit resource indicating the potential to expand the open pit mineral resources down dip and to the northeast along strike. In addition, this hole intersected the vein at 51m below surface confirming the continuity of an upthrown block that brings the San Albino zone closer to surface than previous down dip projections (see press release dated July 27, 2020 and attached plan map).

Results are pending for 23 holes drilled in the West Pit area. Detailed geologic logging indicates that 14 of the holes intersected the mineralized zone as predicted due to the presence of galena and arsenopyrite, with 8 of these holes containing visible gold. One of these holes, SA21-560 intersected a 3.2m wide mineralized zone, 20m outside of the current open pit resources and 40m beyond the current permitted pit limit.

SW Pit

The objective of the drilling in this area is to identify new, open pit and underground mineral resources in the sparsely tested Southwestern portion of the permitted pit boundary. Previous drilling in this area defined limited shallow mineral resources and deeper drilling intersected encouraging mineralized zones. However, the continuity of these deeper zones was not established and most of the intercepts were not included in the MDA Resource.

Recent drilling is aiding in the interpretation of this zone and indicates a potential link between the deeper mineralized zones and the shallow zones over an area of approximately 300m by 130m with extensions up to 413m downdip.

Hole SA21-536 was drilled with a goal of providing a connection between the surface exposure and deeper mineralized intervals drilled by the Company during the 2011-2013 drilling campaign. This drill hole intersected a mineralized interval of 31.70 g/t Au and 39.2 g/t Ag over 2.40 m (1.55m estimated true width) 64m from surface.

In addition, several drill holes tested a surface exposure of the mineralized zone, including drill hole SA21-530, which intercepted 8.43 g/t Au and 10.8 g/t Ag over 1.40m, 10m from surface.

Results are pending for 11 drill holes in the SW Pit area. Detailed geologic mapping indicates that 9 of the drill holes intersected a mineralized zone due to the presence of galena and arsenopyrite, with 5 of these holes containing visible gold.

Table 1: Assay Results Reported in This Press Release

| Area |

Drill hole |

From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

Interval Averages |

Est. true width (m) |

| SW Pit |

SA20-447 |

1.00 |

2.10 |

1.10 |

1.85 |

6.3 |

1.85 g/t Au and 6.3 g/t Ag over 1.10 m |

1.0 |

| 29.10 |

30.10 |

1.00 |

1.97 |

2.5 |

1.97 g/t Au and 2.5 g/t Ag over 1.00 m |

0.9 |

| SA20-448 |

20.80 |

21.40 |

0.60 |

2.24 |

2.8 |

3.13 g/t Au and 4.4 g/t Ag over 1.40 m |

1.4 |

| 21.40 |

22.20 |

0.80 |

3.80 |

5.6 |

| SA20-449 |

5.80 |

6.80 |

1.00 |

5.82 |

17.5 |

5.82 g/t Au and 17.5 g/t Ag over 1.00 m |

0.8 |

| 12.50 |

14.00 |

1.50 |

2.98 |

6.3 |

2.98 g/t Au and 6.3 g/t Ag over 1.50 m |

1.3 |

| SA21-512 |

2.90 |

3.70 |

0.80 |

3.78 |

6.9 |

3.78 g/t Au and 6.9 g/t Ag over 0.80 m |

0.7 |

| 15.20 |

16.20 |

1.00 |

1.26 |

3.8 |

1.26 g/t Au and 3.8 g/t Ag over 1.00 m |

0.9 |

| SA21-513 |

24.80 |

25.50 |

0.70 |

3.43 |

11.9 |

3.43 g/t Au and 11.9 g/t Ag over 0.70 m |

0.5 |

| SA21-514 |

14.80 |

16.00 |

1.20 |

1.90 |

11.5 |

1.75 g/t Au and 9 g/t Ag over 4.40 m |

3.4 |

| 16.00 |

17.00 |

1.00 |

1.19 |

8.1 |

| 17.00 |

18.00 |

1.00 |

0.87 |

4.7 |

| 18.00 |

19.20 |

1.20 |

2.79 |

10.7 |

| SA21-516 |

9.40 |

10.20 |

0.80 |

8.61 |

10.4 |

8.61 g/t Au and 10.4 g/t Ag over 0.80 m |

0.6 |

| SA21-517 |

9.50 |

10.70 |

1.20 |

3.26 |

13.7 |

3.26 g/t Au and 13.7 g/t Ag over 1.20 m |

0.9 |

| SA21-518 |

21.90 |

22.90 |

1.00 |

5.71 |

19.9 |

3.70 g/t Au and 13.2 g/t Ag over 1.80 m |

1.2 |

| 22.90 |

23.70 |

0.80 |

1.20 |

4.8 |

| SA21-524 |

42.70 |

43.50 |

0.80 |

9.80 |

11.6 |

5.36 g/t Au and 9 g/t Ag over 1.70 m |

1.6 |

| 43.50 |

44.40 |

0.90 |

1.41 |

6.6 |

| SA21-529 |

37.00 |

38.00 |

1.00 |

2.45 |

3.9 |

2.45 g/t Au and 3.9 g/t Ag over 1.00 m |

0.5 |

| SA21-530 |

10.50 |

11.20 |

0.70 |

15.10 |

16.6 |

8.43 g/t Au and 10.8 g/t Ag over 1.40 m |

0.9 |

| 11.20 |

11.90 |

0.70 |

1.76 |

4.9 |

| SA21-531 |

45.40 |

46.00 |

0.60 |

2.70 |

44.7 |

2.70 g/t Au and 44.7 g/t Ag over 0.60 m |

0.3 |

| SA21-532 |

|

|

|

|

|

Pending |

|

| SA21-533 |

12.50 |

13.70 |

1.20 |

1.00 |

4.8 |

1.00 g/t Au and 4.8 g/t Ag over 1.20 m |

0.9 |

| SA21-536 |

60.70 |

61.70 |

1.00 |

36.10 |

30.3 |

31.70 g/t Au and 39.2 g/t Ag over 2.40 m |

1.5 |

| 61.70 |

62.60 |

0.90 |

43.80 |

69.3 |

| 62.60 |

63.10 |

0.50 |

1.10 |

2.9 |

| SA21-538 to SA21-548 |

|

|

|

|

|

Pending |

|

| San Albino Pit |

SA21-550 |

|

|

|

|

|

Pending |

|

| SA21-552 |

46.40 |

47.40 |

1.00 |

24.40 |

26.2 |

22.20 g/t Au and 23.1 g/t Ag over 3.80 m |

3.3 |

| 47.40 |

48.30 |

0.90 |

1.70 |

6.6 |

| 48.30 |

49.40 |

1.10 |

2.41 |

5.0 |

| 49.40 |

50.20 |

0.80 |

69.70 |

62.7 |

| SA21-553 to SA22-574 |

|

|

|

|

|

Pending |

|

The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 meter of internal dilution. Widths are reported as drill core lengths. True width is estimated from interpreted sections. In addition to the drill holes presented in the table above, the following drill holes returned only anomalous values: SA20-451, SA20-459, SA20-475, SA20-479, SA20-482, SA20-484, SA20-485, SA20-487, SA20-488, SA20-491, SA20-497, SA20-500, SA20-510, SA21-511, SA21-515, SA21-521, SA21-523, SA21-525, SA21-526, SA21-528, SA21-534, SA21-537. In addition to the drill holes presented in the table above, drill hole SA20-474 did not intersect an interval with significant values. The database with all drilling results to date is available on the Company’s website at www.makominingcorp.com

Table 2: Previously Released Drill Hole Results within SW Pit

(Table contains only intervals not included in the MDA Resource)

| Drill hole |

From (m) |

To (m) |

Width (m) |

Au (g/t) |

Ag (g/t) |

Interval Averages |

Est. true width (m) |

| SA11-23 |

84.50 |

85.50 |

1.00 |

2.19 |

3.9 |

11.65 g/t Au and 16.5 g/t Ag over 3.50m |

3.03 |

| 85.50 |

86.50 |

1.00 |

29.90 |

38.8 |

| 86.50 |

87.50 |

1.00 |

6.40 |

7.4 |

| 87.50 |

88.00 |

0.50 |

4.59 |

15.4 |

| SA11-27 |

105.50 |

106.00 |

0.50 |

14.90 |

51.60 |

14.90 g/t Au and 51.6 g/t Ag over 0.50m |

0.48 |

| 107.50 |

108.00 |

0.50 |

1.48 |

1.30 |

1.30 g/t Au and 1.9 g/t Ag over 1.50m |

1.15 |

| 108.00 |

109.00 |

1.00 |

1.21 |

2.20 |

| 138.50 |

139.50 |

1.00 |

29.90 |

30.20 |

29.90 g/t Au and 30.2 g/t Ag over 1.00m |

0.87 |

| 267.00 |

268.50 |

1.50 |

2.40 |

1.60 |

2.40 g/t Au and 1.6 g/t Ag over 1.50m |

0.96 |

| SA11-25 |

107.00 |

107.50 |

0.50 |

40.77 |

64.90 |

14.76 g/t Au and 25.1 g/t Ag over 2.00m |

1.88 |

| 107.50 |

108.00 |

0.50 |

12.77 |

25.90 |

| 108.00 |

109.00 |

1.00 |

2.74 |

4.70 |

| 116.50 |

118.00 |

1.50 |

2.72 |

9.30 |

2.72 g/t Au and 9.3 g/t Ag over 1.50m |

1.36 |

| SA11-28 |

95.50 |

96.00 |

0.50 |

4.19 |

16.10 |

4.19 g/t Au and 16.1 g/t Ag over 0.50m |

0.43 |

| 116.50 |

117.50 |

1.00 |

1.28 |

3.20 |

1.28 g/t Au and 3.2 g/t Ag over 1.00m |

0.91 |

| 119.00 |

120.00 |

1.00 |

1.30 |

6.10 |

1.30 g/t Au and 6.1 g/t Ag over 1.00m |

0.98 |

| SA11-29 |

110.00 |

110.50 |

0.50 |

4.97 |

101.30 |

4.97 g/t Au and 101.3 g/t Ag over 0.50m |

0.37 |

| 118.50 |

119.00 |

0.50 |

4.61 |

3.90 |

6.48 g/t Au and 10.9 g/t Ag over 1.50m |

1.43 |

| 119.00 |

119.50 |

0.50 |

0.30 |

0.90 |

| 119.50 |

120.00 |

0.50 |

14.52 |

27.90 |

| 126.50 |

127.00 |

0.50 |

9.38 |

20.30 |

4.43 g/t Au and 7.1 g/t Ag over 2.00m |

1.97 |

| 127.00 |

128.00 |

1.00 |

0.27 |

2.20 |

| 128.00 |

128.50 |

0.50 |

7.80 |

3.70 |

| 176.00 |

176.50 |

0.50 |

107.82 |

84.60 |

107.82 g/t Au and 84.6 g/t Ag over 0.50m |

0.49 |

| SA12-62 |

31.55 |

32.50 |

0.95 |

2.84 |

4.10 |

2.84 g/t Au and 4.1 g/t Ag over 0.95m |

0.82 |

| 41.00 |

42.00 |

1.00 |

1.78 |

2.20 |

1.78 g/t Au and 2.2 g/t Ag over 1.00m |

0.87 |

| 182.50 |

183.50 |

1.00 |

7.01 |

4.80 |

7.01 g/t Au and 4.8 g/t Ag over 1.00m |

0.77 |

| 306.15 |

307.00 |

0.85 |

9.86 |

44.70 |

6.76 g/t Au and 25.2 g/t Ag over 2.55m |

2.49 |

| 307.00 |

308.00 |

1.00 |

7.80 |

20.40 |

| 308.00 |

308.70 |

0.70 |

1.51 |

8.20 |

| SA12-67 |

169.50 |

170.50 |

1.00 |

3.57 |

5.80 |

33.89 g/t Au and 26.9 g/t Ag over 2.55m |

2.43 |

| 170.50 |

171.00 |

0.50 |

22.16 |

34.70 |

| 171.00 |

171.50 |

0.50 |

125.12 |

82.10 |

| 171.50 |

172.05 |

0.55 |

16.74 |

7.80 |

| SA12-68 |

184.70 |

185.50 |

0.80 |

31.96 |

100.10 |

30.25 g/t Au and 70.7 g/t Ag over 1.30m |

1.26 |

| 185.50 |

186.00 |

0.50 |

27.52 |

23.60 |

| 188.00 |

189.20 |

1.20 |

1.03 |

3.80 |

1.03 g/t Au and 3.8 g/t Ag over 1.20m |

1.13 |

| 200.50 |

201.50 |

1.00 |

6.03 |

22.10 |

6.03 g/t Au and 22.1 g/t Ag over 1.00m |

0.97 |

| SA12-70 |

151.00 |

152.00 |

1.00 |

1.92 |

4.10 |

1.92 g/t Au and 4.1 g/t Ag over 1.00m |

0.87 |

| 181.25 |

182.30 |

1.05 |

18.30 |

49.10 |

42.10 g/t Au and 48.4 g/t Ag over 1.55m |

1.46 |

| 182.30 |

182.80 |

0.50 |

92.08 |

46.90 |

| 184.50 |

185.15 |

0.65 |

6.70 |

10.80 |

6.70 g/t Au and 10.8 g/t Ag over 0.65m |

0.52 |

| 213.00 |

214.00 |

1.00 |

1.06 |

3.90 |

1.06 g/t Au and 3.9 g/t Ag over 1.00m |

0.77 |

| SA13-107 |

177.50 |

179.00 |

1.50 |

8.22 |

18.10 |

8.22 g/t Au and 18.1 g/t Ag over 1.50m |

1.36 |

| 184.40 |

185.40 |

1.00 |

62.68 |

81.80 |

62.68 g/t Au and 81.8 g/t Ag over 1.00m |

0.98 |

| 188.50 |

189.50 |

1.00 |

1.89 |

3.90 |

1.89 g/t Au and 3.9 g/t Ag over 1.00m |

0.87 |

| 281.00 |

282.00 |

1.00 |

5.36 |

18.30 |

5.36 g/t Au and 18.3 g/t Ag over 1.00m |

0.94 |

| 298.00 |

299.00 |

1.00 |

3.44 |

5.10 |

3.44 g/t Au and 5.1 g/t Ag over 1.00m |

0.91 |

| SA13-108 |

57.60 |

58.50 |

0.90 |

6.08 |

30.30 |

6.08 g/t Au and 30.3 g/t Ag over 0.90m |

0.82 |

| 183.50 |

185.00 |

1.50 |

21.02 |

22.30 |

21.02 g/t Au and 22.3 g/t Ag over 1.50m |

1.30 |

Sampling, Assaying, QA/QC and Data Verification

Drill core was continuously sampled from inception to termination of the entire drill hole. Sample intervals were typically one meter. Drill core diameter was HQ (6.35 centimeters). Geologic and geotechnical data was captured into a digital database, core was photographed, then one-half split of the core was collected for analysis and one-half was retained in the core library. Trench and surface channel samples followed a similar procedure as drill core sampling. Continuous samples were collected using a diamond saw or rock hammer and chisel. Care was taken to ensure a consistent channel width of 6 cm wide and 5 cm depth. Individual channel samples range from 0.4 meters to 1.0 meters in length. Both drill core and channel samples were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas and pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. Gold was analyzed by standard fire assay fusion, 30 gram aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards and blanks were inserted into the sample stream at a ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data.

Equity Compensation Grants

The Company also announces that it has granted an aggregate of 1,503,800 Restricted Share Units ("RSUs") to certain executive officers of the Company and an aggregate of 494,400 Deferred Share Units (“DSUs”) to the non-executive directors of the Company under the terms of the Company's Omnibus Incentive Plan (the "Plan"). Each RSU and DSU represents the right to receive, once vested, one common share in the capital of the Company (the “Shares”) or the cash equivalent thereof, as may be determined in the discretion of the board of directors of the Company pursuant to the terms of the Plan. The DSUs vest upon termination of services of the participant, and the RSUs vest as to (i) 50% on January 31, 2023; (ii) 25% on December 31, 2024; and (iii) 25% on December 1, 2024.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

CEO

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered “forward-looking information” within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company’s plans and certain expectations and assumptions, including that management believes that an increase in the mineral resources at both the West Pit and SW Pit areas at San Albino is likely as a result of the drilling program; that two drill rigs are scheduled to arrive at site later this week to accelerate the San Albino drilling and the Company’s plans to increase the total rig count to 8; the Company will release new and pending results once received;; and that the Company can operate San Albino profitably in order to fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, the risk that the ongoing results of the drilling program do not result in a significant increase in mineral resources at the West Pit and the SW Pit areas; there is a delay in the arrival of the additional drill rigs; the Company is unable to operate San Albino profitably and/or fund its exploration of prospectus targets on its district-scale land package; political risks and uncertainties involving the Company’s exploration properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company’s public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s expectations regarding the Company’s drilling program at San Albino gold project, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.