Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) (“Mako” or the “Company”) is pleased to report additional results from its recent definition and expansion drilling program at the Las Conchitas area on its wholly-owned San Albino-Murra property. The Las Conchitas area is located immediately south of the San Albino Mine which is currently in commercial production, and north of the historical El Golfo Mine located within the contiguous El Jicaro Concession.

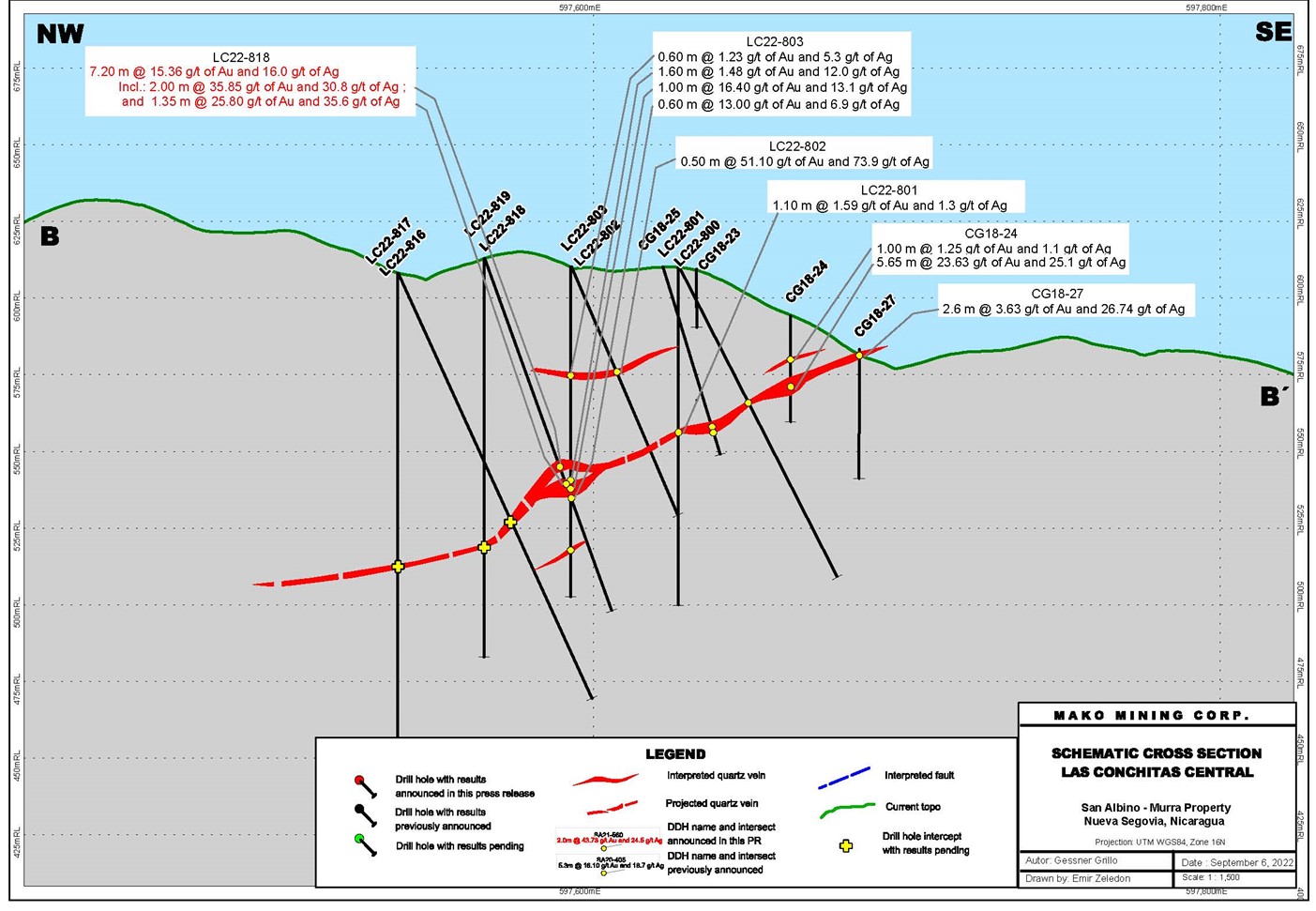

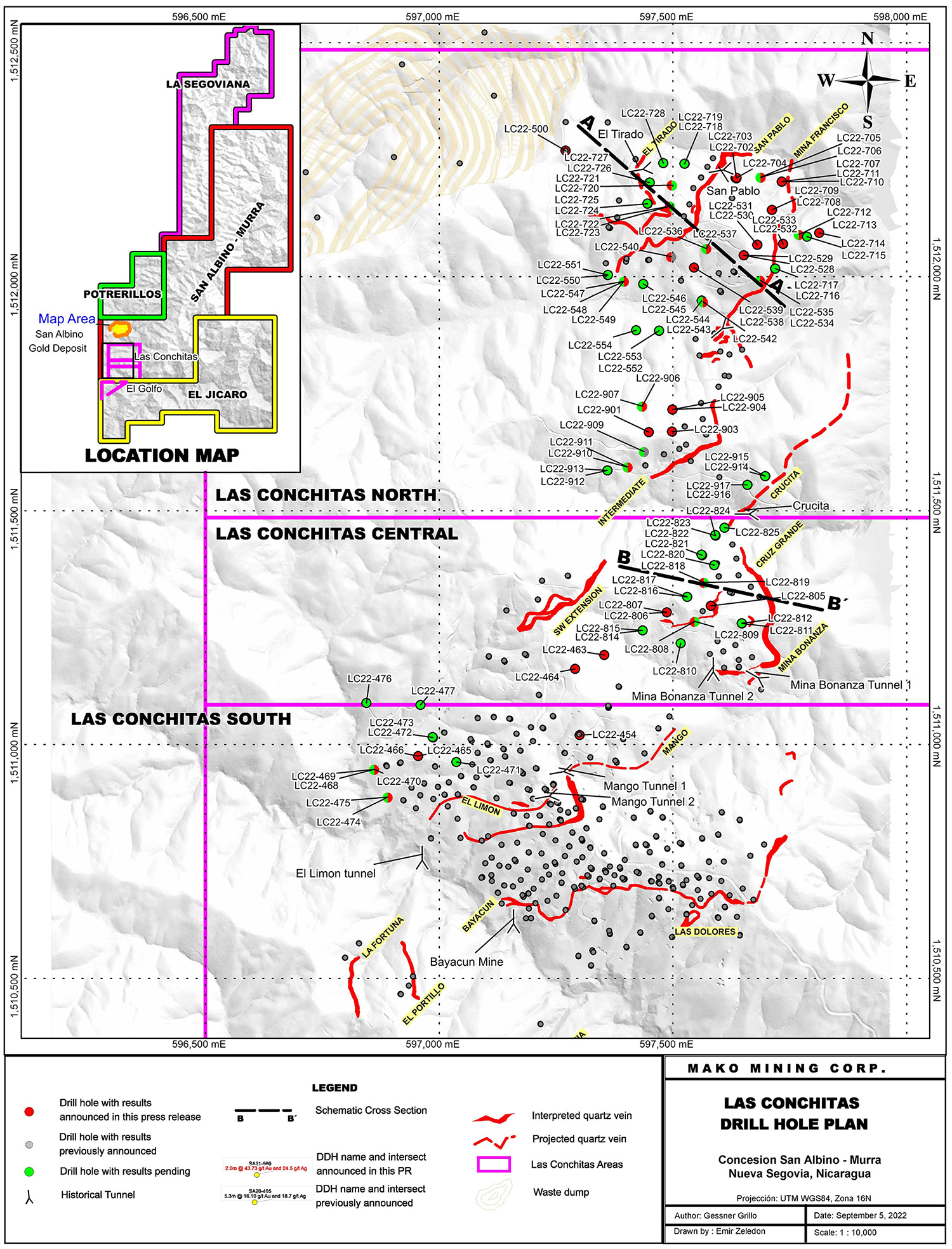

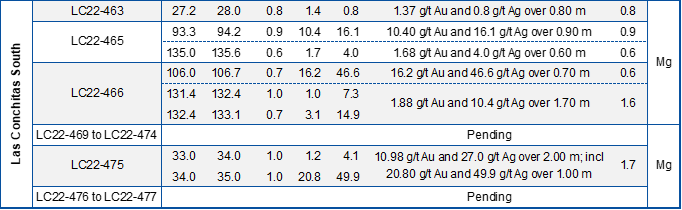

Currently, the Company has five of its seven diamond drill rigs in the Las Conchitas area, which is subdivided into three primary areas: Las Conchitas North (“LC-N”), Las Conchitas Central (“LC-C”) and Las Conchitas South (“LC-S”). Each of these areas host multiple, subparallel, northeast-southwest striking, gently dipping, gold bearing veins interpreted to be orogenic in nature. To date, a total of 63,136 meters (m) have been completed in 610 diamond drill holes within the entire Las Conchitas area.

Highlights of the recent drilling at Las Conchitas:

Las Conchitas - Central

- Cruz Grande (“CG”)

- 15.36 g/t Au and 16.0 g/t Ag over 7.2m (6.7m ETW)

Including 35.85 g/t Au and 30.8 g/t Ag over 2.0m (1.9m ETW);

and 25.80 g/t Au and 35.6 g/t Ag over 1.3m (1.3m ETW)

Las Conchitas - North

- Mina Francisco (“MF”)

- 25.81 g/t Au and 45.4 g/t Ag over 1.1m (1.0m ETW)

- 20.17 g/t of Au and 16.5 g/t Ag over 1.2m (1.0m ETW)

- San Pablo 2 (“SP2”) - New Zone

- 12.88 g/t of Au and 18.0 g/t Ag over 3.1m (2.7m ETW)

Las Conchitas - South

- Mango (“Mg”)

- 10.98 g/t Au and 27.0 g/t Ag over 2.0m (1.7m ETW)

- 10.40 g/t Au and 16.1 g/t Ag over 0.9m (ETW)

Note * ETW is estimated true width measured from interpreted sections

Akiba Leisman, CEO of Mako states that “at Las Conchitas – Central, hitting 15.3 g/t Au over 6.7 meters ETW, less than 70 meters from surface is a great result for the Company. More importantly, this is showing continuity, with similar grades and widths over significant strike and dip extensions from this hole. LC-C is still a relatively untested area of Las Conchitas, but it is shaping up to be yet another high grade and open-pittable target across our 188 square kilometer land package. Additional results at Las Conchitas are showing continuity along strike and down dip, and will be important as Mako continues the process of updating our resource in Q1 2023 to include all of these areas within Las Conchitas which were not included in any previous resource estimate.”

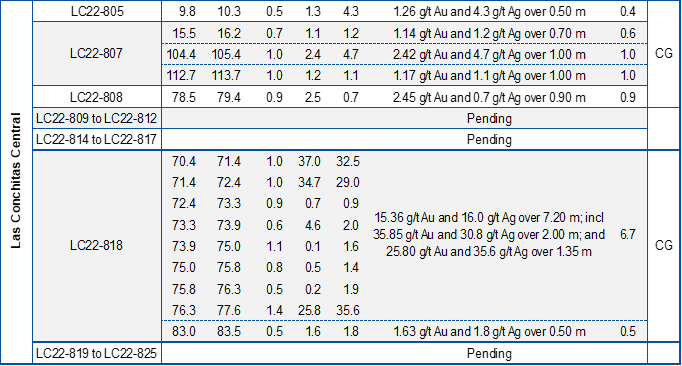

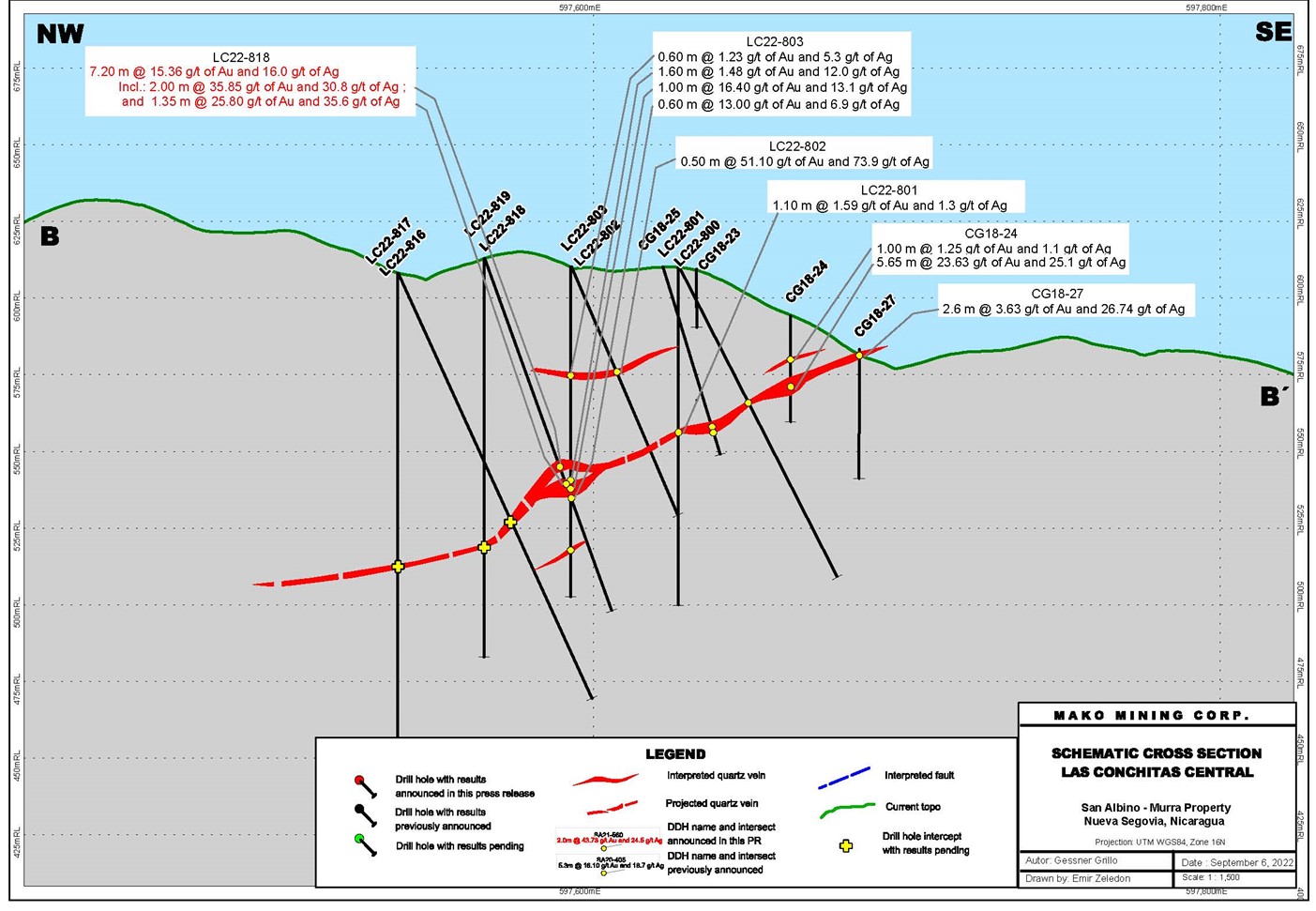

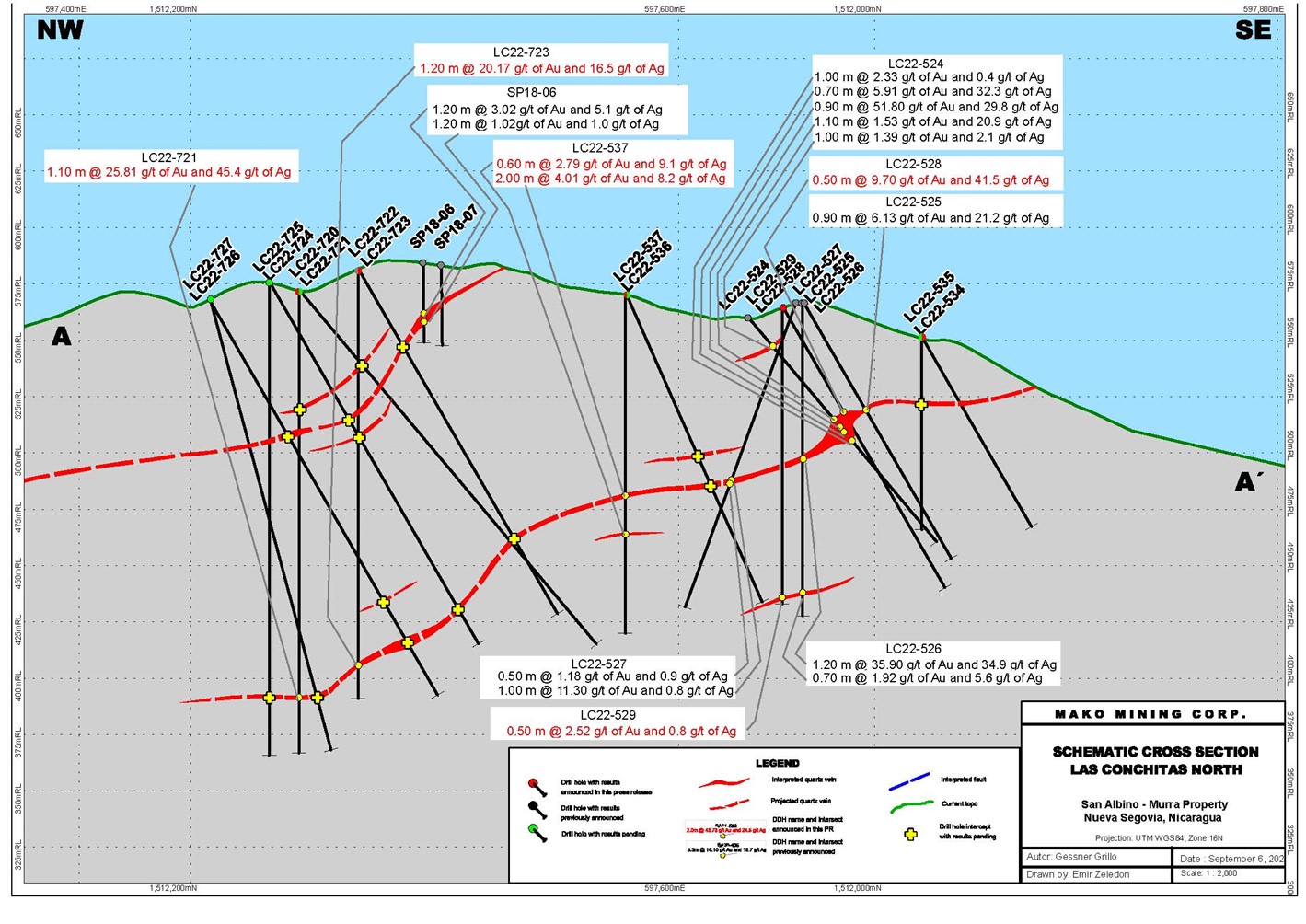

Las Conchitas – Central

Recent drilling at LC-C has confirmed the continuity of areas previously interpreted as separate zones (Cruz Grande and Mina Bonanza), and has significantly increased the potential for open pittable mineralization (see press release dated August 18, 2022). Drill hole LC22-818 intersected a 7.2m wide mineralized interval (6.7m ETW), at 15.36 g/t Au and 16.0 g/t Ag, 69.2m below surface (see table below and Figure 3 - Cross Section B-B’). The interval contains two mineralized quartz veins grading 35.85 g/t Au and 30.8 g/t Ag over 2.0m (1.9m ETW) and 25.80 g/t Au and 35.6 g/t Ag over 1.4m (1.3m ETW) respectively, separated by mineralized country rock (see table below). This drill hole confirmed an 82m down dip extension of the near surface mineralization encountered in hole CG18-24, which intersected an interval of 23.63 g/t Au and 25.1 g/t Ag over 5.7m (4.3m ETW), 20.4m below surface and 56m from drill hole CG18-25, which intersected 11.31 g/t Au and 12.2 g/t Ag, over 4.2m (3.7m ETW), 36.6m below surface (see press release dated December 8, 2018). Additional holes are planned to test the potential strike and dip extension of this zone.

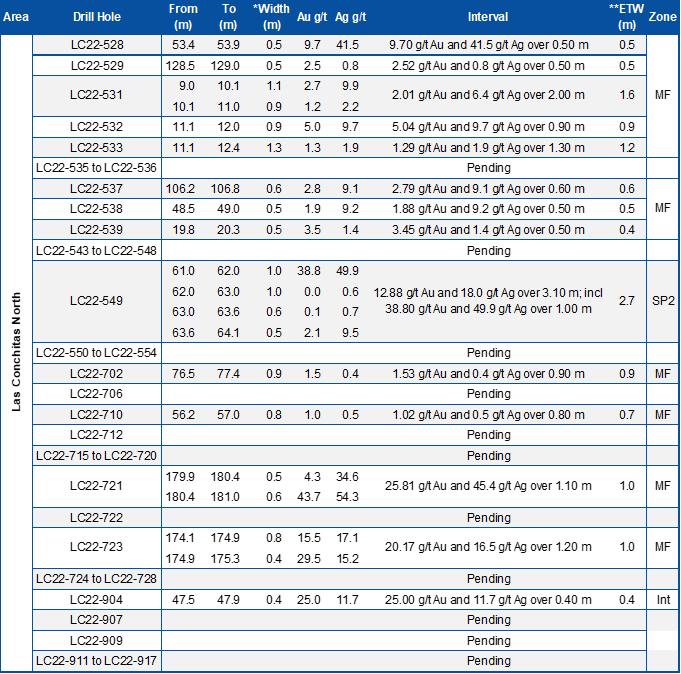

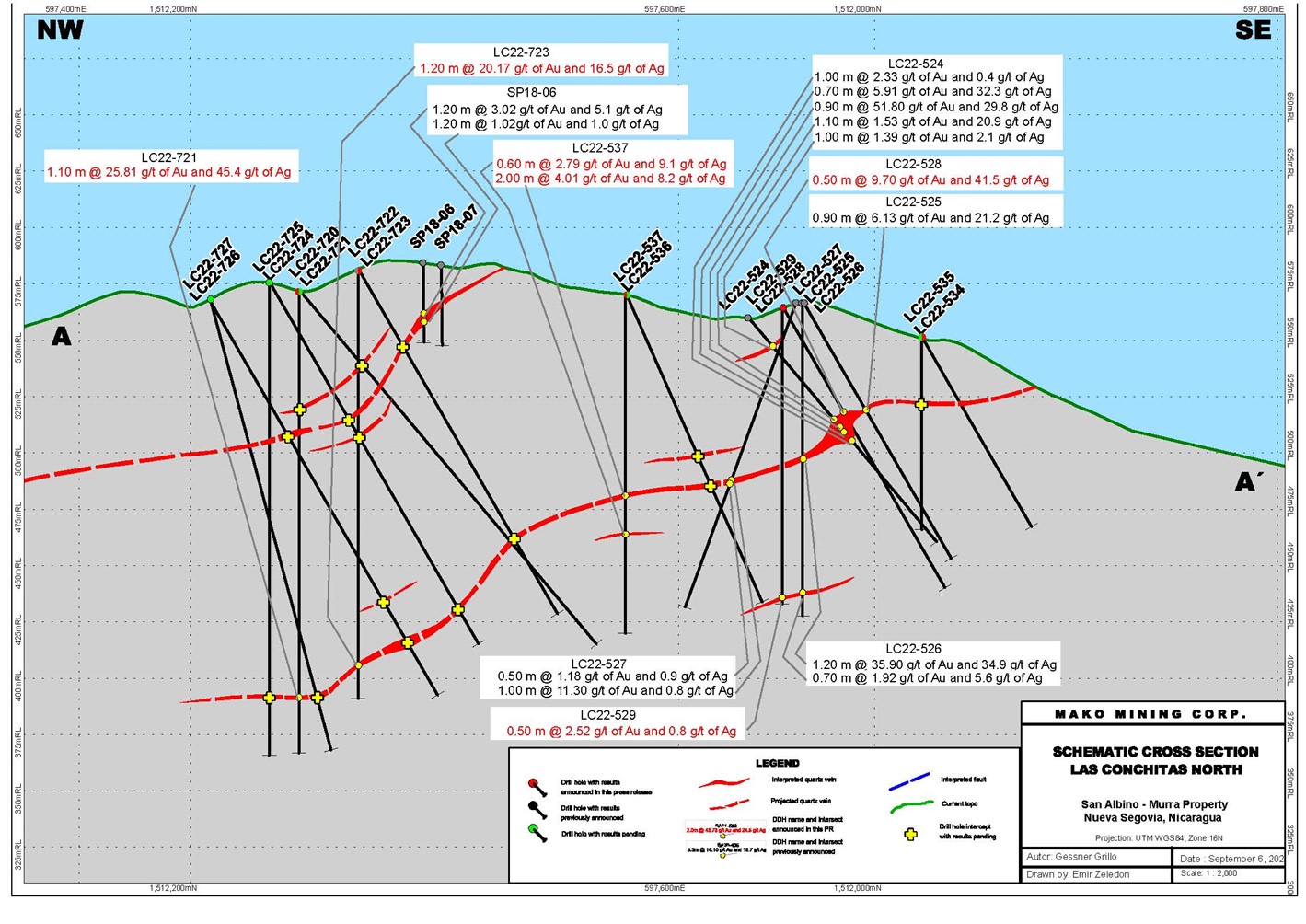

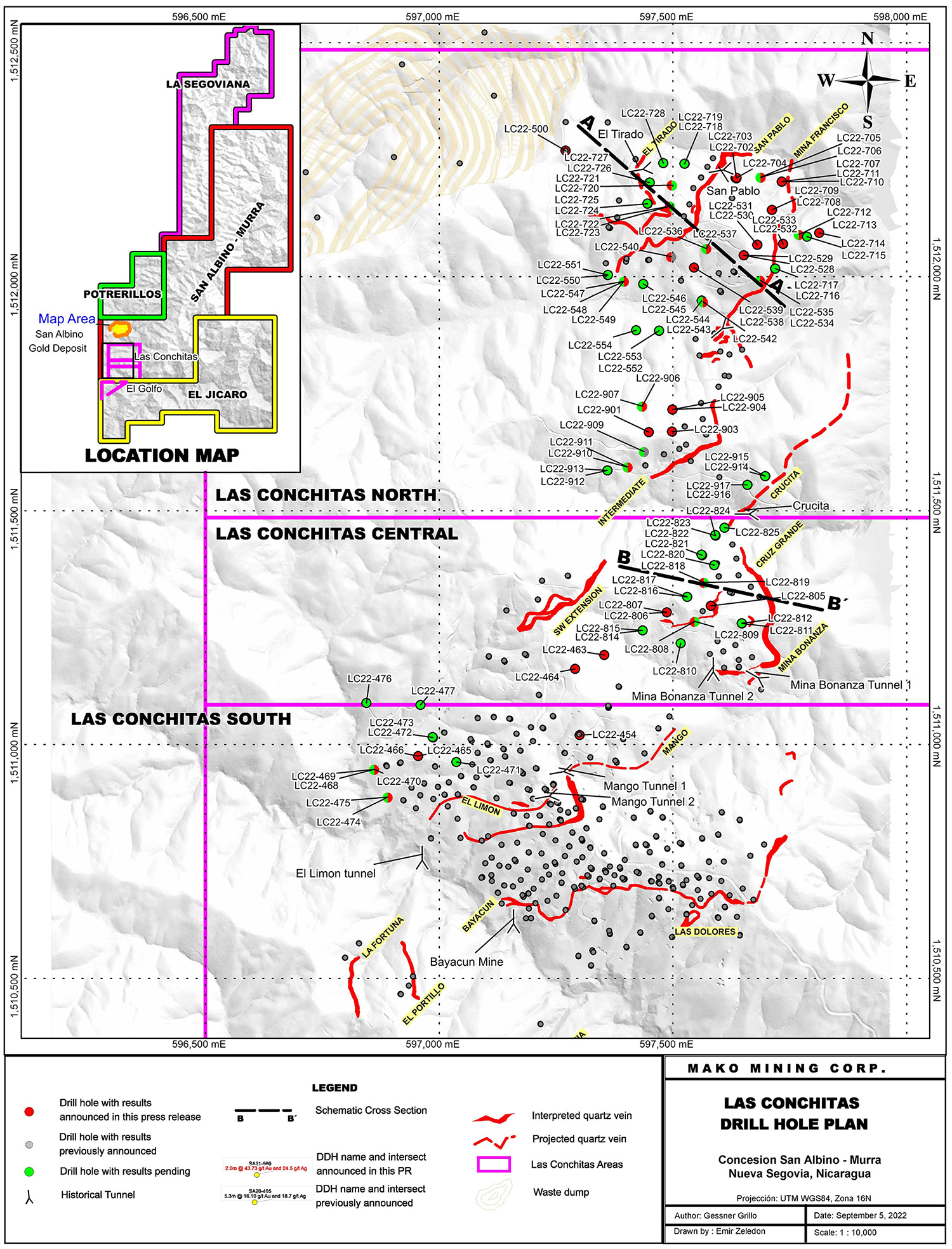

Las Conchitas – North

2022 drilling at LC-N has outlined multiple stacked mineralized zones, including the recently identified Mina Francisco mineralization, which comprises two separate veins. To date, a total of 15,600 meters (m) in the 2022 drilling campaign have been completed in 106 drill holes at the LC-N area. The objective of the drilling presented in this press release was to test mineralization amenable to both open pit and underground mining methods.

Two drill rigs are testing the extension of the Mina Francisco structure. At the north slope of San Pablo hill (see drill plan), drill hole LC22-721 intersected 25.81 g/t Au and 45.4 g/t Ag over 1.1m (1.0m ETW), 179m from surface. Drill hole LC22-723 intersected 20.17 g/t Au and 16.5 g/t Ag over 1.2m (1.0m ETW), 174m below surface (see table below and Cross Section A-A’). Drill hole LC22-549, collared at the south slope and 191m along strike from drill hole LC22-723 (described above), intersected the Mina Francisco structure at 147.5m below surface (results pending). This hole also intersected 12.88 g/t Au and 18.0 g/t Ag over 3.1m (2.7m ETW), 55m below surface, currently interpreted as a new zone, San Pablo 2 (“SP2”).

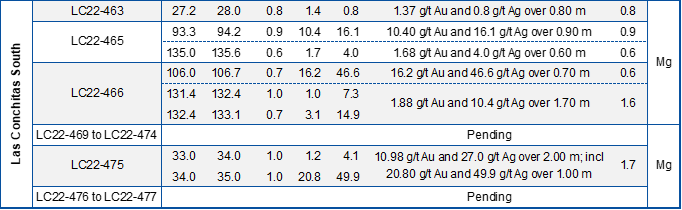

Las Conchitas – South

The objective of the current drilling at LC-S is to extend previously identified mineralized structures both along strike and dip. Several drill holes were designed to test the extension of the Mango zone intersected by drill hole LC19-101 grading 19.55 g/t Au and 40.6 g/t Ag over 1.2m (see press release dated August 19, 2019). Drill hole LC22-475 intersected 10.98 g/t Au and 27.0 g/t Ag over 2.0m (1.7m ETW), including 20.80 g/t Au and 49.9 g/t Ag over 1.0m, approximately 39m southwest by strike from the intercept of drill hole LC19-101 and situated 33m from surface. This drill hole confirmed down dip extension for a total of 195.4m and indicates that mineralization is open to the SW. Drill hole LC22-465 tested the northeast extension of the Mango zone and intersected 10.40 g/t Au and 16.1 g/t Ag over 0.90m (ETW), 76m below surface, successfully extending the zone along strike for additional 68m.

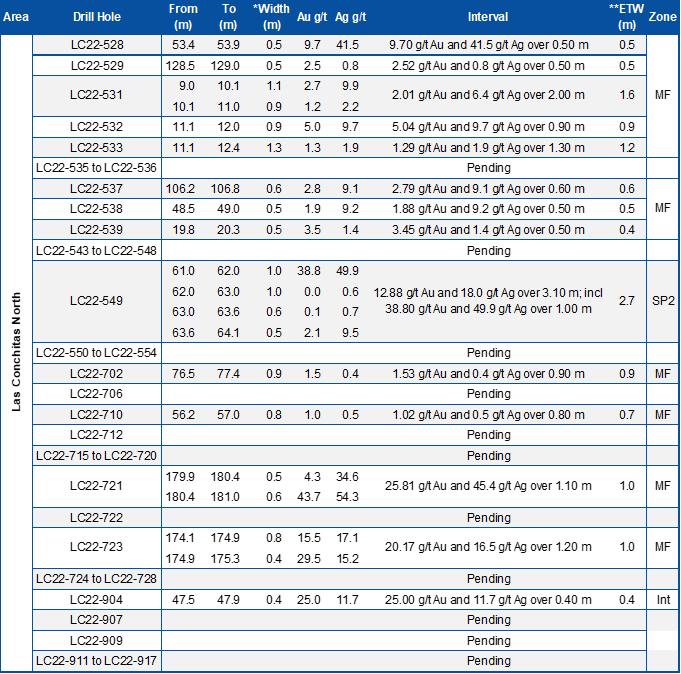

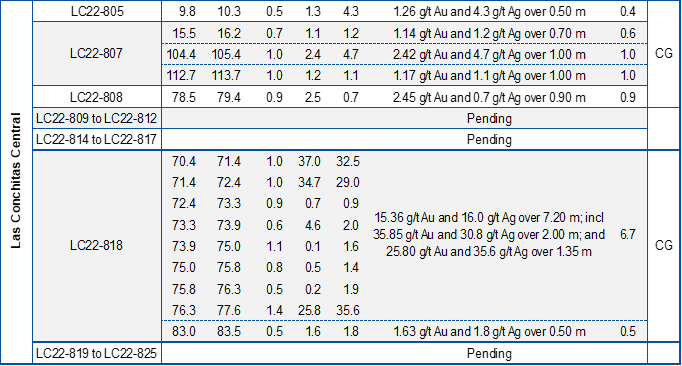

Table: Assay Results Reported in This Press Release

Note: The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0m of internal dilution except for holes LC22-549 and LC22-818 which include up to 2.35m of internal dilution. *Widths are reported as drill core lengths. **Estimated True Width is estimated from interpreted sections. In addition to the drill holes presented in the table above, the following drill holes returned only anomalous values: LC22-454, LC22-464, LC22-530, LC22-534, LC22-540, LC22-542, LC22-703 to LC22-705, LC22-708, LC22-709, LC22-711, LC22-713, LC22-806, LC22-903, LC22-906 and LC22-910. In addition to the drill holes presented in the table above, the following drill holes returned no significant values: LC22-468, LC22-500, LC22-707, LC22-714, LC22-901 and LC22-905.

Sampling, Assaying, QA/QC and Data Verification

Drill core was continuously sampled from inception to termination of the entire drill hole. Sample intervals were typically one meter with a minimum sample width of 50 cm. Drill core diameter was HQ (6.35 centimeters). Geologic and geotechnical data was captured into a digital database, core was photographed, then one-half split of the core was collected for analysis and one-half was retained in the core library.

Samples were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas and pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. Gold was analyzed by standard fire assay fusion, 30-gram aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards, and blanks were inserted into the sample stream at a ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data. No top cut has been applied to the reported assay results.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Information

Statements contained herein that are not historical fact are considered “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is based on management’s current expectations, beliefs and assumptions, and includes, without limitation: the objectives of the drilling campaign; the plan to continue drilling the Las Conchitas area with five of the seven diamond drill rigs on site with the objective of further expansion of the mineralized structures in all three areas in preparation for a maiden resource by Q1 2023; the expectation of additional discoveries; and that the Company meets its object of operating San Albino profitably while continuing to fund exploration of prospective targets. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, the risk that additional satisfactory exploration results will not be obtained; the risk that the Company will not release additional exploration results on the timeline expected; the risk that additional discoveries will not continue; that exploration results will not translate into the discovery of an economically viable deposit; risks and uncertainties relating to political risks involving the Company’s exploration and development of mineral properties interests; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations, the inability or failure to obtain adequate financing on a timely basis and other risks and uncertainties disclosed in the Company’s public filings at www.sedar.com. Forward-looking information contained herein is based on management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s plans and expectations at the Las Conchitas area, and may not be appropriate for other purposes.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1 – Drill Hole Plan

Figure 2 – Cross Section A-A’

Figure 3 – Cross Section B-B’