Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) (“Mako” or the “Company”) is pleased to report the results of an updated mineral resource estimate prepared by RESPEC, out of Reno, Nevada, for the San Albino Project, which includes the Las Conchitas deposit, located in Nueva Segovia, Nicaragua. An updated technical report for the San Albino Project with an effective date of October 11th, 2023, including the updated mineral resource estimate, is being prepared in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) and will be filed under the Company’s SEDAR+ profile at www.sedarplus.ca within 45 days of this news release, and posted on the Company’s website at www.makominingcorp.com. All dollar amounts referred to in this news release are United States dollars.

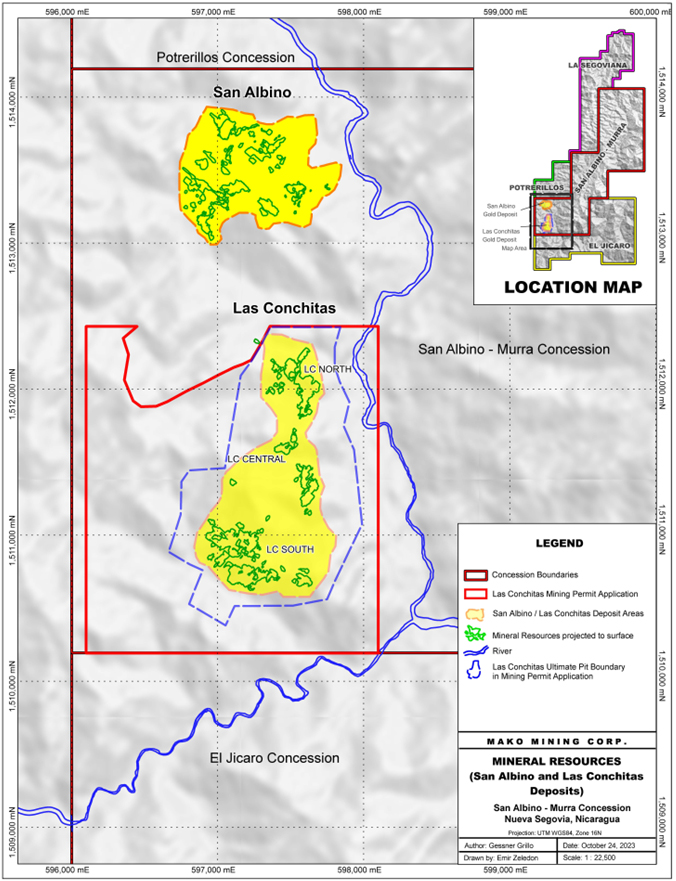

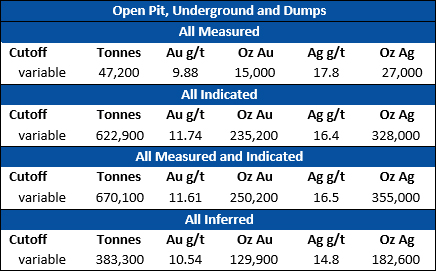

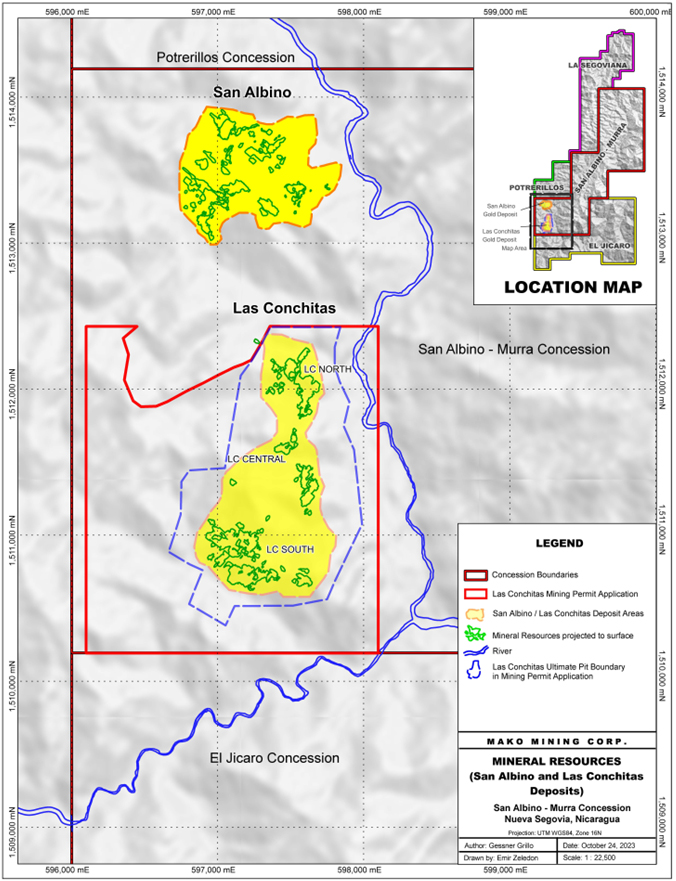

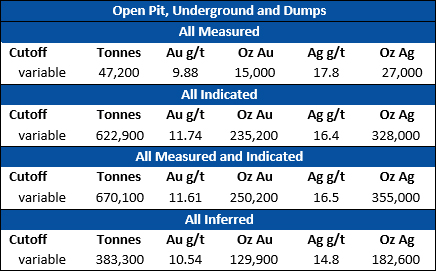

The San Albino Project open pit and underground mineral resource (see Figure 1 map below) includes a Measured and Indicated mineral resource of 670,100 tonnes at a diluted grade of 11.61 grams per tonne (g/t) Au for 250,200 gold ounces, and an Inferred mineral resource of 383,300 tonnes at a diluted grade of 10.54 g/t Au for 129,900 gold ounces (see table below). These mineral resources are constrained within two major and three smaller open pit shells at the Las Conchitas deposit, and four pit shells at the San Albino mine, two of which are currently in operation. The underground mineral resources are constrained by shells defined by stope optimizations.

Akiba Leisman, CEO of Mako states, “even after nearly 4 years of depletion from the San Albino mine, our mineral resource is now materially larger and higher grade than the last mineral resource we published over 3 years ago. There was over 100km of new drilling that went into this mineral resource update, which was all funded through operating cash flow, with our last equity raise occurring in July 2020. Initial mining has already begun at the new areas contained within this mineral resource update; therefore, no additional capital is required to begin extracting these ounces. The modelling of this mineral resource was done with attention to detail, incorporating all the empirical knowledge the team has collected by mining a very similar geology at San Albino since early 2020. Modelling decisions were made with the understanding that there is a high probability that we will positively reconcile to the published mineral resource with additional drilling. In addition, the areas delineated in this mineral resource are open along strike and down dip. Lastly, the areas encompassed within this mineral resource account for just 1% of the 188km2 orogenic gold mining district we have at the San Albino Project. With the robust cash flows currently coming from the operating mine, we continue to be focused on delineating additional deposits on our property, with dozens of advanced prospects across 28 km of strike potential.”

San Albino and Las Conchitas Permitting and Development

The San Albino mine is fully permitted and has been in commercial production since July 1, 2021, and the Las Conchitas deposit is located immediately to the south. The geology at Las Conchitas is very similar to the San Albino deposit, consisting of stacked, gently dipping (averaging 30 degrees), less than 1 to 3 meter (m) wide, high-grade, gold-quartz veins interpreted to be part of a larger orogenic system.

The Company received an interim permit to begin mining at Las Conchitas in June, 2023. Material extracted from two test pits at Las Conchitas has been processed at the Company’s San Albino plant. The permit allows for the extraction from six areas of interest (Las Dolores, San Pablo, Mina Francisco, Bayacun, Mango, and El Limon).

In July 2023, the Company submitted the Environmental Impact Assessment (“EIA”) for the development of the Las Conchitas deposit in Nicaragua. The EIA has been accepted by the Nicaraguan Ministry of Environment and Natural Resources (MARENA) and the company anticipates approval by the end of 2023.

San Albino and Las Conchitas Mineral Resource Modelling

Explicit modelling, which involved geologists directly interpreting every polygon within the model, was used to create the mineral resource estimate for the San Albino Project. This approach more accurately predicts the location and grade of mineral resources when compared to implicit modelling, which relies on commercial software to interpret these polygons, and has proven successful at San Albino to date. However, because the drilling is wider spaced than at the San Albino deposit, the modelling was somewhat restrictive on projections of veins. It is expected that infill drilling at Las Conchitas may increase the estimated mineral resources.

Both the San Albino and Las Conchitas deposits were initially modelled on sections spaced 10m apart. These sectional interpretations were reviewed by Mako geologists and modifications were made until there was a mutually agreed-upon interpretation. These interpretations were used to code the database by domain and vein name. After evaluating each vein’s assays statistically, capping levels were defined and assigned, and then compositing was done to one-meter lengths respecting the vein and halo boundaries. The cross-section interpretations were snapped to the drill holes in three dimensions, sliced vertically along N40E long sections, and reinterpreted on one-meter intervals. These long sections were then treated as solids for coding the block model and controlling the estimate.

The San Albino deposit has three main groups of veins - San Albino, Naranjo, and Arras – each with multiple splays. Las Conchitas has 16 veins, each of which was modelled and estimated separately. A polygonal estimate was completed for each deposit to anticipate its size and grade and to be a check on the resource estimates. The one-meter composites were used to estimate gold and silver grades using inverse-distance cubed, kriging, and nearest-neighbor methods. Multiple estimates were made to evaluate sensitivity to estimation parameters and to optimize those estimation parameters. While the three types of estimates (and the polygonal estimate) were used to check each other, the reported estimate used inverse-distance cubed.

The block models are rotated 40o parallel to the strike of the deposits. Block sizes are one-meter high by two-meters along strike by one-meter across strike. Gold and silver grades were estimated for the veins, halos, and the unmineralized material. Vein grades were diluted depending on the material types adjacent to the vein by any or all of: a) the footwall halo, b) hanging wall halo, or c) unmineralized material. For open pit resources at San Albino a 0.5m dilution rind was applied on both the top and the bottom of the veins, while at Las Conchitas a 0.4m dilution rind was applied on both the top and the bottom of the veins. A thinner dilution rind was applied at Las Conchitas because production shows that dilution can be less than 0.5m on the hanging wall. Because little engineering work has been done for underground mining, the underground mineral resources reported are block diluted.

Input Parameters for Open Pit and Underground Optimizations to Define Resource Shells

For evaluating the open-pit potential, a series of optimized pits were run using variable gold prices and parameters. The accepted mining cost was $3/t, processing cost $65/t, and G&A cost $2/t. Metallurgical recoveries of gold used in the pit optimizations were 83%, 90%, and 95% for fresh rock, transition, and oxide material, respectively. Silver was not considered in the optimizations. For evaluating the potential for underground mining, a series of stope optimizations were run at variable cutoffs. An average underground-mining cost of $144/t, processing cost of $65/t, and G&A of $2/t were assumed. Underground mineral resources are those at or above the 4.0 g/t Au cutoff lying within the 3.0 g/t Au optimized stopes. The factors used in defining cutoff grades are based on a gold price of $1,750/oz.

Qualified Person

Steven Ristorcelli, C.P.G., independent geologist and qualified person (as defined under NI 43-101) has read and approved the scientific and technical information contained in this press release.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, E-mail: aleisman@makominingcorp.com, Phone number: 917-558-5289 or visit our website at www.makominingcorp.com and SEDAR+ at www.sedarplus.ca.

Forward-Looking Information: Some of the statements contained herein may be considered “forward-looking information” within the meaning of applicable securities laws. Forward-looking information can be identified by words such as, without limitation, “estimate", "project", "believe", "anticipate", "intend", "expect", "plan", "predict", "may" or "should" or variations thereon or comparable terminology. The forward-looking information contained herein reflects the Company’s current beliefs and expectations, based on management’s reasonable assumptions, and includes, without limitation, the expectation that the Company will file its updated technical report within 45 days of this news release; the Company anticipating the approval by MARENA of its EIA by the end of 2023; the Company’s understanding that there is high probability that it can positively reconcile additional drilling to the published mineral resource estimate; the Company’s focus on delineating additional deposits on its property; the Company having dozens of advanced prospects across 28 km of strike potential; that the geology at Las Conchitas is part of a larger orogenic system; the Company’s expectation that infill drilling at Las Conchitas may increase the estimated mineral resources; and Mako’s primary objective to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, changes in the Company’s exploration and development plans and growth parameters; unexpected results from continued exploration work at the San Albino Project; the Company’s ability to fund its growth; unanticipated costs; the October 24, 2022 sanction measures imposed in connection with Nicaragua by the Office of Foreign Assets Control of the U.S. Department of Treasury having impacts on business operations not currently expected, or new sanctions being imposed in Nicaragua by such office or other government entity in the future; and other risks and uncertainties as disclosed in the Company’s public disclosure filings on SEDAR+ at www.sedarplus.ca. Such information contained herein represents management’s best judgment as of the date hereof, based on information currently available. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Figure 1