Mako Mining Corp. (TSX-V: MKO; OTCQB: MAKOF) (“Mako” or the “Company”) is pleased to report positive drill results from the Bayacun Zone within the Las Conchitas area of its wholly-owned San Albino-Murra property located in Nueva Segovia, Nicaragua. The Las Conchitas area is located approximately 2.5 kilometers south of the fully permitted San Albino gold project currently under construction.

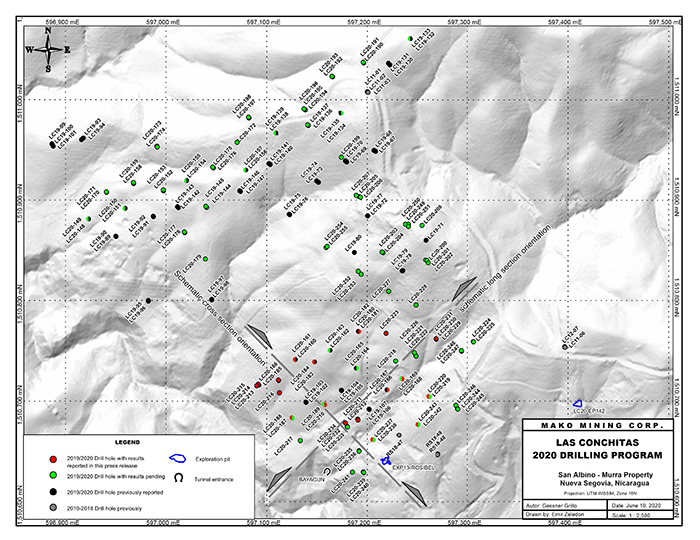

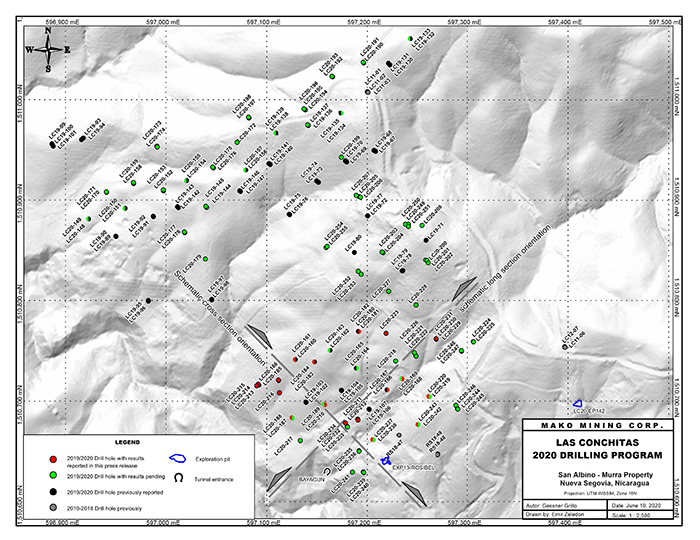

The goal of the 2020 drill program at Las Conchitas is to focus on the most promising zones of near surface, shallow dipping, high-grade gold mineralization in order to delineate a maiden resource estimate. Since 2019, the Company has completed 65 shallow diamond drill holes totaling 4,351.70 meters (“m”) within the Bayacun Zone, which is among the most promising zones within the Las Conchitas area. A total of 15,052.75 m within 197 holes have been drilled at Las Conchitas since the start of the 2019-20 drilling campaign.

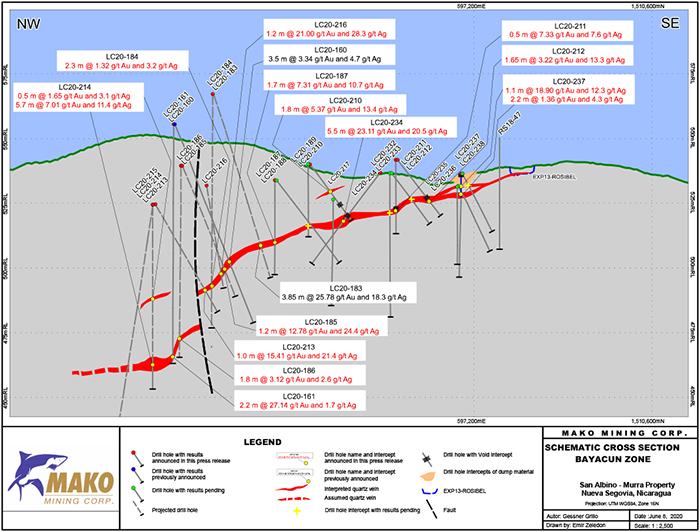

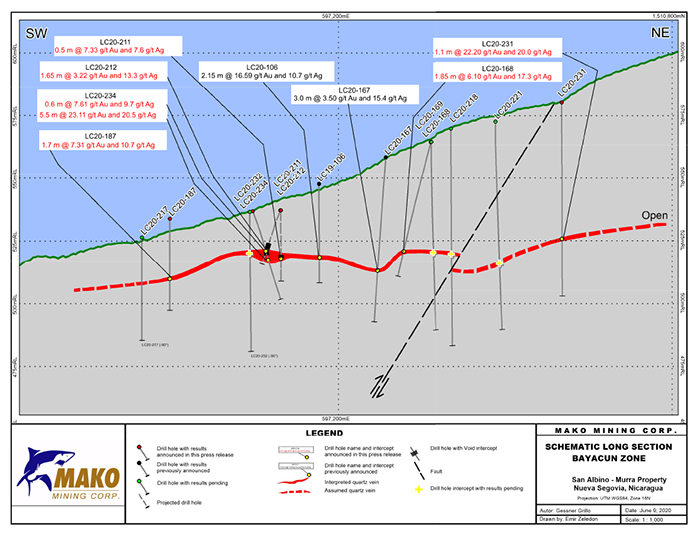

This press release includes 23 holes with assay results from the Bayacun Zone (see attached map). Additionally, the Company has previously released assay results from 15 holes from the Bayacun Zone (see press preleases dated September 10, 2019, March 11, 2020 and March 25, 2020). A breakdown of the 38 holes reported to date are as follows:

- 20 holes with composite interval averages greater than 15 g/t Au, including 9 in this press release

- 9 holes with composite interval averages ranging from 5 g/t to 15 g/t Au, including 8 in this press release

- 6 holes with composite interval averages ranging from 1 g/t Au to 5 g/t Au, including 3 in this press release

- 3 holes with values below cut-off grade (less than 1 g/t Au), all reported in this press release, with 1 intersecting a dyke where the vein was expected and the other 2 disturbed by faults

Importantly, 23 of the 38 holes reported to date at the Bayacun Zone encountered at least 1 assay greater than 15 g/t Au.

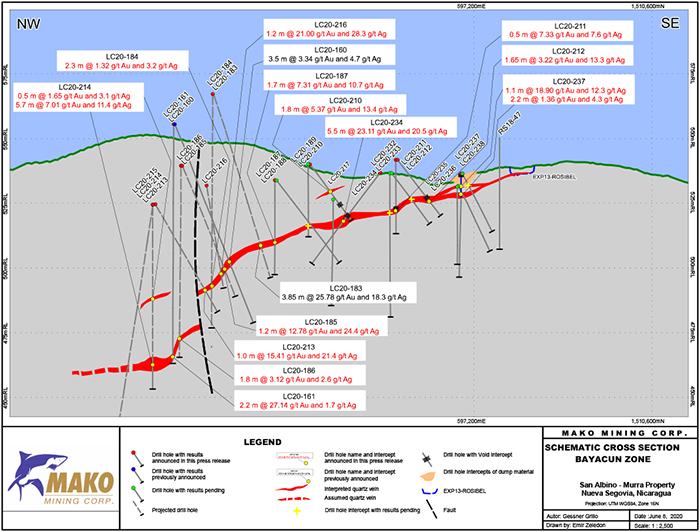

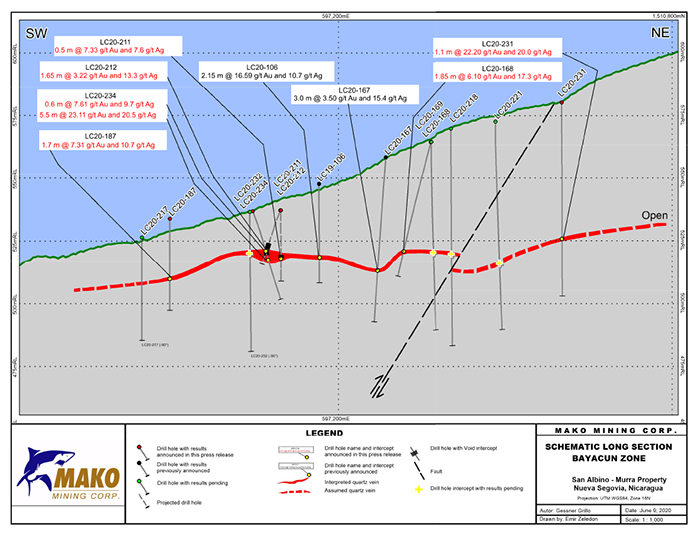

The highest grade x thickness interval reported in this press release comes from hole LC20-234, which was designed to test the strike extension of the Bayacun Zone encountered in previous drilling. Specifically, LC20-234 intersected 23.11 g/t Au and 20.5 g/t Ag over 5.5 m immediately below a void and a sample of mineralized quartz vein grading 7.61 g/t Au and 9.7 g/t Ag over 0.60 m. It is assumed that a portion of the mineralized zone (1.9 m wide) has been mined out and the down-hole and true thickness of the entire zone is calculated as 8.0 m and 4.4 m, respectively (see attached cross and long sections). Mineralization in this hole begins 14.6 m from surface.

Other notable intercepts include LC20-220 which intersected 93.3 g/t Au and 61.4 g/t Ag over 0.9 m and LC20-161 which intersected 27.14 g/t Au and 1.7 g/t Ag over 2.2 m. LC20-161 was drilled to test the down-dip continuity of the zone, which has now been expanded to over 160 m.

Drill results to date from the Bayacun Zone indicate approximate dimensions of 180 m along strike by 160 m down dip and continues to be open along strike and at depth.

In addition to drilling, assay results from sampling within exploration pit LC20-EP142 indicate that the strike dimensions of the Bayacun Zone have the potential of being meaningfully expanded. Specifically, exploration pit LC20-EP142 is situated approximately 200 m from the Rosibel Pit and dump (see attached map) and has returned channel sample assays of 27.9 g/t Au and 43.9 g/t Au over 0.8 m (vertical), 17.6 g/t Au and 26.1 g/t Ag over 1.2 m (true width) and 16.9 g/t Au and 33.1g/t Ag over 0.8 m (vertical). The channel samples are continuous samples perpendicular to the vein using a rock saw and chisel to collect a consistent 10 centimeter wide by 8 centimeter deep sample.

Drilling is presently being focused down-dip of the surface exposure in exploration pit LC20-EP142 to confirm the potential strike expansion.

Akiba Leisman, Chief Executive Officer of Mako states, “these high-grade shallow intercepts at Bayacun have been extremely predictable now that our understanding of the geologic controls at this zone have been refined. Although the results at Bayacun are noteworthy, it is important to remember that Bayacun is only a part of the overall Las Conchitas area. There remain a multitude of targets at Las Conchitas that have seen promising results with only limited drilling, and our overall goal is to link these targets together into a maiden resource to supplement mining activities a few kilometers to the north at San Albino.”

There are 27 additional drill holes still awaiting assay results from the Bayacun Zone.

Bayacun Zone Assay Results Reported In This Press Release

| Drill Hole |

From

(m) |

To

(m) |

Width

(m)* |

Au

(g/t) |

Ag

(g/t) |

Interval Averages |

True Width

(m)**** |

| LC20-161 |

89.00 |

90.00 |

1.00 |

1.41** |

0.8 |

27.14 g/t Au and 1.7 g/t Ag over 2.2 m |

1.50 |

| 90.00 |

91.20 |

1.20 |

48.58** |

2.5 |

| LC20-166 |

|

|

|

|

|

No significant results |

|

| LC20-168 |

49.50 |

50.10 |

0.60 |

15.06** |

28.4 |

6.10 g/t Au and 17.3 g/t Ag over 1.85 m |

1.50 |

| 50.10 |

50.90 |

0.80 |

0.40** |

3.7 |

| 50.90 |

51.35 |

0.45 |

4.27** |

26.6 |

| LC20-169 |

|

|

|

|

|

Results pending |

|

| LC20-180 |

|

|

|

|

|

No significant results |

|

| LC20-184 |

73.20 |

74.50 |

1.30 |

1.24** |

1.3 |

1.32 g/t Au and 3.2 g/t Ag over 2.30 m |

2.00 |

| 74.50 |

75.50 |

1.00 |

1.43** |

5.6 |

| LC20-185 |

43.40 |

44.60 |

1.20 |

12.78** |

24.4 |

12.78 g/t Au and 24.4 g/t Ag over 1.20 m |

1.10 |

| LC20-186 |

65.80 |

66.70 |

0.90 |

3.06** |

3.8 |

3.12 g/t Au and 2.6 g/t Ag over 1.80 m*** |

1.00 |

| 66.70 |

67.60 |

0.90 |

3.18** |

1.4 |

| LC20-187 |

23.20 |

24.90 |

1.70 |

7.31** |

10.7 |

7.31 g/t Au and 10.7 g/t Ag over 1.70 m |

1.50 |

| LC20-188 to 189 |

|

|

|

|

|

Results pending |

|

| LC20-210 |

12.60 |

13.90 |

1.30 |

6.88** |

16.4 |

5.37 g/t Au and 13.4 g/t Ag over 1.80 m |

1.70 |

| 13.90 |

14.40 |

0.50 |

1.44** |

5.6 |

| 19.45 |

22.45 |

3.00 |

|

|

Void |

|

| LC20-211 |

18.00 |

20.00 |

2.00 |

|

|

Void |

|

| 20.50 |

21.00 |

0.50 |

7.33** |

7.6 |

7.33 g/t Au and 7.6 g/t Ag over 0.50 m |

0.40 |

| LC20-212 |

17.40 |

19.85 |

2.45 |

|

|

Void |

|

| 19.85 |

20.50 |

0.65 |

6.04** |

15.8 |

3.22 g/t Au and 13.3 g/t Ag over 1.65 m |

1.50 |

| 20.50 |

21.50 |

1.00 |

1.38** |

11.7 |

| LC20-213 |

37.80 |

38.80 |

1.00 |

15.41** |

21.4 |

15.41 g/t Au and 21.4 g/t Ag over 1.00 m |

1.00 |

| LC20-214 |

36.40 |

36.90 |

0.50 |

1.65** |

3.1 |

1.65 g/t Au and 3.1 g/t Ag over 0.50 m |

0.40 |

| 59.00 |

60.00 |

1.00 |

4.25** |

5.5 |

7.01 g/t Au and 11.4 g/t Ag over 5.70 m |

3.10 |

| 60.00 |

61.00 |

1.00 |

0.22** |

0.5 |

| 61.00 |

61.70 |

0.70 |

4.14** |

4.4 |

| 61.70 |

62.60 |

0.90 |

6.87** |

17.1 |

| 62.60 |

63.60 |

1.00 |

4.66** |

3.3 |

| 63.60 |

64.70 |

1.10 |

19.77** |

33.8 |

| LC20-215 |

56.30 |

57.30 |

1.00 |

0.13** |

0.7 |

No significant results |

|

| LC20-216 |

34.10 |

35.30 |

1.20 |

21.00 |

28.3 |

21.00 g/t Au and 28.3 g/t Ag over 1.20 m |

1.10 |

| LC20-217 to 219 |

|

|

|

|

|

Results pending |

|

| LC20-220 |

27.20 |

28.10 |

0.90 |

93.30 |

61.4 |

93.30 g/t Au and 61.4 g/t Ag over 0.90 m |

0.80 |

| 44.00 |

45.00 |

1.00 |

1.70 |

275.0 |

1.70 g/t Au and 275.0 g/t Ag over 1.00 m |

0.90 |

| LC20-221 to 222 |

|

|

|

|

|

Results pending |

|

| LC20-223 |

104.80 |

105.30 |

0.50 |

1.95 |

2.9 |

8.44 g/t Au and 15.9 g/t Ag over 1.30 m |

1.00 |

| 105.30 |

106.10 |

0.80 |

12.50 |

24.0 |

| LC20-224 to 228 |

|

|

|

|

|

Results pending |

|

| LC20-229 |

46.30 |

47.40 |

1.10 |

21.70 |

34.0 |

21.70 g/t Au and 34.0 g/t Ag over 1.10 m |

1.00 |

| LC20-230 |

54.45 |

55.5 |

1.05 |

9.66 |

23.1 |

9.66 g/t Au and 23.1 g/t Ag over 1.05 m |

1.00 |

| LC20-231 |

54.00 |

55.10 |

1.10 |

22.20 |

20.0 |

22.20 g/t Au and 20.0 g/t Ag over 1.10 m |

1.00 |

| LC20-232 to 233 |

|

|

|

|

|

Results pending |

|

| LC20-234 |

20.00 |

20.60 |

0.60 |

7.61 |

9.7 |

7.61 g/t Au and 9.7 g/t Ag over 0.60m |

0.35 |

| 20.60 |

22.50 |

1.90 |

|

|

Void |

|

| 22.50 |

23.70 |

1.20 |

3.63 |

8.2 |

23.11 g/t Au and 20.5 g/t Ag over 5.5 m |

3.00 |

| 23.70 |

24.70 |

1.00 |

3.05 |

3.1 |

| 24.70 |

25.80 |

1.10 |

9.37 |

29.9 |

| 25.80 |

27.00 |

1.20 |

7.32 |

12.7 |

| 27.00 |

28.00 |

1.00 |

100.60 |

51.6 |

| LC20-235 to 236 |

|

|

|

|

|

Results pending |

|

| LC20-237 |

0.00 |

1.50 |

1.50 |

1.03 |

1.8 |

Historical dump*** |

|

| 1.50 |

3.00 |

1.50 |

1.66 |

2.7 |

| 3.00 |

4.50 |

1.50 |

0.95 |

1.6 |

| 4.50 |

5.60 |

1.10 |

18.90 |

12.3 |

18.90 g/t Au and 12.3 g/t Ag over 1.10 m |

1.00 |

| 7.00 |

8.20 |

1.20 |

1.46 |

2.3 |

1.36 g/t Au and 4.3 g/t Ag over 2.20 m |

1.60 |

| 8.20 |

9.20 |

1.00 |

1.23 |

6.6 |

| LC20-238 to 241 |

|

|

|

|

|

Results pending |

|

| LC20-242 |

37.65 |

38.65 |

1.00 |

47.70 |

72.5 |

47.70 g/t Au and 72.5 g/t Ag over 1.00 m |

0.80 |

| LC20-243 to 248 |

|

|

|

|

|

Results pending |

|

The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 meter of internal dilution. *Widths are reported as drill core lengths. ** Indicates use of metallic screening method for assays. *** Historical dump is interpreted to be "waste" material from the mining operations during the period 1870-1920 and possibly during Spanish times. The grade and distribution of Historical dump material can be erratic and unpredictable. **** True width is estimated from interpreted sections.

Sampling, Assaying, QA/QC and Data Verification

Drill core was continuously sampled from inception to termination of the drill hole. Sample intervals were typically one meter. Drill core diameter was HQ (6.35 centimeters). Geologic and geotechnical data was captured into a digital database, core was photographed, then one-half split of the core was collected for analysis and one-half was retained in the core library. Samples were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas and pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. Gold was analyzed by standard fire assay fusion, 30-gram aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. Due to the presence of coarse gold, the Company has used 500-gram metallic screened gold assays for analyzing samples from mineralized veins and samples immediately above and below drilled veins. This method, which analyzes a larger sample, can be more precise in high-grade vein systems containing coarse gold. All reported drill results in this press release using the metallic screening method are indicated. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards, and blanks were inserted into the sample stream at a ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data. No top cut has been applied to the reported assay results.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under National Instrument 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration firm. The Company is developing its high-grade San Albino gold project in Nueva Segovia, Nicaragua. Mako’s primary objective is to bring San Albino into production quickly and efficiently, while continuing exploration of prospective targets in Nicaragua.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Statements: Some of the statements contained herein may be considered “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is based on certain expectations and assumptions, including that: the goal of the 2020 drill program at Las Conchitas, being to focus on the most promising zones of near surface, shallow dipping, high-grade gold mineralization in order to delineate a maiden resource estimate, will ultimately be achieved; the assumption that a portion of the mineralized zone (1.9 m wide) within the Bayacun Zone has been mined out and the down-hole and true thickness of the entire zone is calculated as 8.0 m and 4.4 m, respectively, as discussed in this press release will prove to be accurate; the remaining multitude of targets at Las Conchitas that have seen promising results with only limited drilling will contribute to the Company’s overall goal of linking these targets together into a maiden resource to supplement mining activities at San Albino; the Company’s exploration programs will be successfully completed; a maiden resource at the Las Conchitas may be delineated as a result of the Company’s 2020 drilling; and the Company will be successful in any financing plans necessary for drilling and construction at the San Albino project. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, the risks that additional satisfactory exploration results at the Bayacun Zone will not be obtained; the risk that the Company’s drilling at Las Conchitas in 2020 will not delineate a maiden resource at the Las Conchitas area; that exploration results will not translate into the discovery of an economically viable deposit; risks and uncertainties relating to political risks involving the Company’s exploration and development of mineral properties interests; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations, the inability or failure to obtain adequate financing on a timely basis and other risks and uncertainties. Such information contained herein represents management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s plans and expectations at its San Albino project and the Las Conchitas area, and may not be appropriate for other purposes.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.