Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) (“Mako” or the “Company”) is pleased to report positive drill results from the Bayacun Zone within the Las Conchitas area of its wholly-owned San Albino-Murra property located in Nueva Segovia, Nicaragua. The Las Conchitas area is located approximately 2.5 kilometers south of the fully permitted San Albino gold project (“San Albino”) currently under construction.

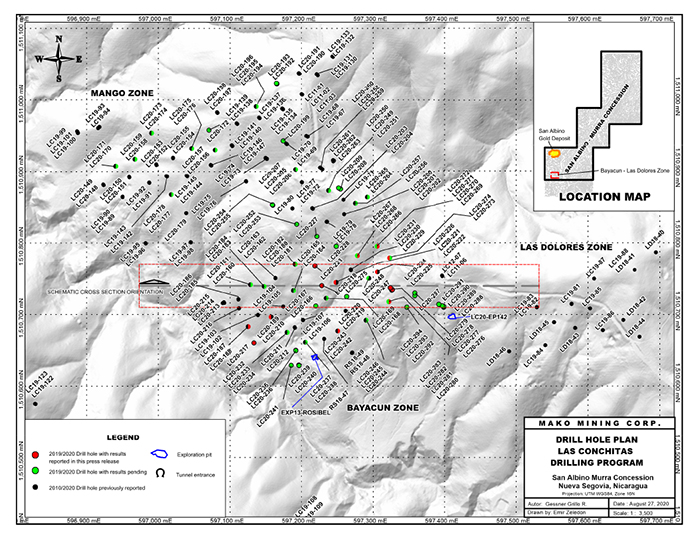

The goal of the 2020 drill program at Las Conchitas is to identify near surface, shallow dipping, high-grade gold mineralization and delineate a maiden resource estimate. Since 2019, the Company has focused on the Bayacun Zone, completing 96 shallow diamond drill holes totaling 6,785.60 meters (“m”). This zone appears to be one of the most promising zones to delineate a near term resource within the Las Conchitas area. A total of 17,842.75 m within 295 holes have been drilled at Las Conchitas since the start of the 2019-20 drilling campaign.

This press release includes results from 22 holes (see attached map), which were designed to further test the strike and dip extension and to improve the understanding of structural controls at the Bayacun Zone. Ten holes intersected a fault zone and experienced poor core recoveries.

Highlights

- Confirmed mineralization in a previously untested fault block

- 22.26 g/t Au and 44.6 g/t Ag over 4.50 m in hole LC20-277

- Intersected mineralization at significantly wider intervals than the average reported to date

- 22.26 g/t Au and 44.6 g/t Ag over 4.50 m (4.30 m true width) in hole LC20-277

- 11.71 g/t Au and 25.5 g/t Ag over 5.50 m (5.00 m true width) in hole LC20-278

- Multiple mineralized zones intersected in most holes

- Three separate zones, including 28.21 g/t Au and 43.1 g/t Ag over 2.80 m in hole LC20-280

- Located the historical Las Dolores tunnel

- 14.68 g/t Au and 39.1 g/t Ag over 2.65 m above a 4.0 m void in hole LC20-276

- Confirmed extension of the Bayacun Zone to 220 m strike by 160 m dip and remains open in both directions

Akiba Leisman, Chief Executive Officer of Mako states, “today’s release highlights the widest zones encountered at Las Conchitas to date. In addition, the grades are consistent with previous near surface, high-grade results. Historically, the Las Conchitas area was considered second in importance to San Albino but was consistently neglected by previous operators. We have taken a different approach and have continued drilling at Las Conchitas while advancing San Albino into production. Our view is that delineating a maiden resource at Las Conchitas is essential, especially now that the Company has the greenlight to process up to 1,000 tonnes per day.”

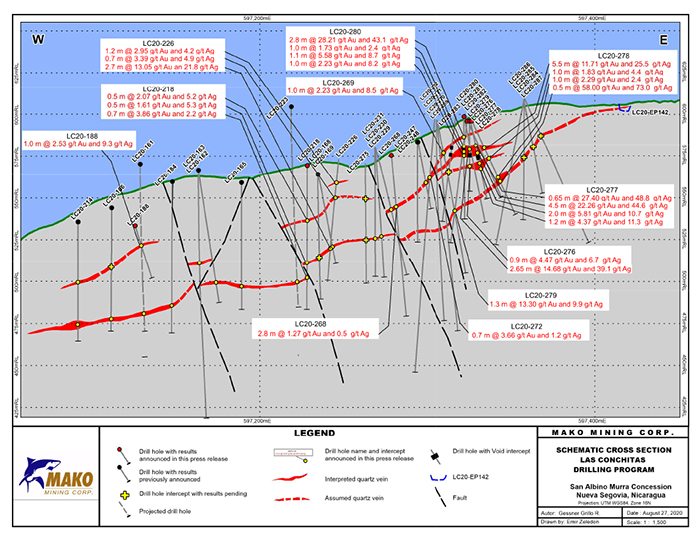

The conceptual model for the mineralization encountered at Las Conchitas consists of multiple, parallel, gold-bearing quartz veins with a gentle dip to the northwest. The veins appear to be related to compressional tectonics and are associated with later faulting and local folding which accounts for changes in vein orientation both along strike and dip. Vein minerology and morphology share several characteristics that are consistent with the model for orogenic gold-bearing veins. Local, abrupt changes in vein orientation may account for the limited historical exploration within the area. The last documented exploration was conducted in 1921, using hand dug tunnels.

Specific Commentary on Significant Drill Holes Reported in this Press Release

LC20-276 is the first drill hole which intersected the lost Las Dolores tunnel, which is described in the 1921 report referred to above. Mineralized veins were encountered both above and below the 4.0 m wide void, with intervals of 14.68 g/t Au and 39.1 g/t Ag over 2.65 m and 4.47 g/t Au and 6.7 g/t Ag over 0.90 m, respectively. The Las Dolores vein exhibits similar gold grades and mineralized widths as the San Albino vein.

LC20-277 intersected three shallow, gold-bearing intervals and a 2.5 m void over 17.05 m (16.1 m true width). This hole has one of the widest, shallow, gold-bearing intervals encountered to date in the Las Conchitas area (see attached cross section).

Additional drilling is planned in the area surrounding LC20-277 to determine the nature and orientation of this exceptionally wide zone.

A breakdown of significant intercepts within drill hole LC20-277 are as follows:

- At 14.0 m below surface, 27.40 g/t Au and 48.8 g/t Ag over 0.65 m (0.60 m true width)

- At 17.0 m below surface, 22.26 g/t Au and 44.6 g/t Ag over 4.50 m (4.30 m true width)

- At 22.0 m below surface, a 2.5 m void, interpreted as a historical tunnel developed on a high-grade vein

- At 24.0 m below surface, 5.81 g/t Au and 10.7 g/t Ag over 2.00 m (2.00 m true width)

- At 27.0 m below surface, 4.37 g/t Au and 11.3 g/t Ag over 1.20 m (1.00 m true width)

LC20-278 was collared at the same drill pad as LC20-277, with a different azimuth (130/-60) and approximately 8 m apart, and intercepted four separate mineralized intervals, including 11.71 g/t Au and 25.5 g/t Ag over 5.50 m (5.0 m true width) and 58.00 g/t Au and 73.0 g/t Ag over 0.50 m (0.50 m true width). Mineralization in LC20-278 begins 15.5 m from surface.

Bayacun Zone Assay Results Reported in this Press Release

| Drill Hole |

From (m) |

To

(m) |

Width

(m)* |

Au

(g/t) |

Ag

(g/t) |

Interval Averages |

True Width

(m)*** |

| LC20-188 |

15.50 |

16.50 |

1.00 |

2.53** |

9.3** |

2.53 g/t Au and 9.3 g/t Ag over 1.00 m |

0.90 |

| LC20-189 |

22.75 |

23.60 |

0.85 |

7.77** |

12.0** |

4.77 g/t Au and 9.0 g/t Ag over 2.25 m |

2.00 |

| 23.60 |

25.00 |

1.40 |

2.95** |

7.2** |

| LC20-217 |

0.00 |

6.00 |

6.00 |

|

|

Historical dump |

|

| LC20-218 |

33.00 |

33.50 |

0.50 |

2.07** |

5.2** |

2.07 g/t Au and 5.2 g/t Ag over 0.5 m |

0.40 |

| 58.50 |

59.00 |

0.50 |

1.61** |

5.3** |

1.61 g/t Au and 5.3 g/t Ag over 0.5 m |

0.50 |

| 67.40 |

68.10 |

0.70 |

3.86** |

2.2** |

3.86 g/t Au and 2.2 g/t Ag over 0.7 m |

0.60 |

| LC20-223 |

104.80 |

105.30 |

0.50 |

2.62** |

2.9** |

8.35 g/t Au and 15.9 g/t Ag over 1.3 m |

1.00 |

| 105.30 |

106.10 |

0.80 |

11.93** |

24** |

| LC20-224 |

45.00 |

46.20 |

1.20 |

7.09** |

4.8** |

7.09 g/t Au and 4.8 g/t Ag over 1.2 m |

1.10 |

| LC20-226 |

44.30 |

45.50 |

1.20 |

2.95** |

4.2** |

2.95 g/t Au and 4.2 g/t Ag over 1.2 m |

1.00 |

| 59.50 |

60.20 |

0.70 |

3.39** |

4.9** |

3.39 g/t Au and 4.9 g/t Ag over 0.7 m |

0.50 |

| 99.00 |

100.00 |

1.00 |

12.75** |

24.3** |

13.05 g/t Au and 21.8 g/t Ag over 2.7 m |

1.50 |

| 100.00 |

100.65 |

0.65 |

30.95** |

47.5** |

| 100.65 |

101.70 |

1.05 |

2.25** |

3.5** |

| LC20-276 |

16.05 |

17.70 |

1.65 |

4.37 |

22.2 |

14.68 g/t Au and 39.1 g/t Ag over 2.65 m |

2.50 |

| 17.70 |

18.70 |

1.00 |

31.70 |

67.0 |

| 21.40 |

25.40 |

4.00 |

|

|

Void |

|

| 27.10 |

28.00 |

0.90 |

4.47 |

6.7 |

4.47 g/t Au and 6.7 g/t Ag over 0.90 m |

0.80 |

| LC20-277 |

17.35 |

18.00 |

0.65 |

27.40 |

48.8 |

27.40 g/t Au and 48.8 g/t Ag over 0.65 m |

0.60 |

| 18.00 |

19.00 |

1.00 |

0.29 |

2.3 |

Anomalous values |

2.90 |

| 19.00 |

20.00 |

1.00 |

0.05 |

0.5 |

| 20.00 |

21.00 |

1.00 |

0.16 |

0.5 |

| 21.00 |

22.10 |

1.10 |

4.93 |

9.2 |

22.26 g/t Au and 44.6 g/t Ag over 4.50 m |

4.30 |

| 22.10 |

23.20 |

1.10 |

56.10 |

97.4 |

| 23.20 |

24.10 |

0.90 |

10.70 |

25.6 |

| 24.10 |

24.90 |

0.80 |

0.48 |

7.7 |

| 24.90 |

25.50 |

0.60 |

19.00 |

54.7 |

| 25.50 |

26.50 |

1.00 |

0.60 |

2.3 |

Anomalous values |

0.90 |

| 26.50 |

29.00 |

2.50 |

|

|

Void |

2.30 |

| 29.00 |

30.00 |

1.00 |

4.72 |

10.2 |

5.81 g/t Au and 10.7 g/t Ag over 2.00 m |

2.00 |

| 30.00 |

31.00 |

1.00 |

6.89 |

11.1 |

| 31.00 |

32.00 |

1.00 |

0.79 |

2.8 |

Anomalous values |

2.10 |

| 32.00 |

33.20 |

1.20 |

0.06 |

1.6 |

| 33.20 |

34.40 |

1.20 |

4.37 |

11.3 |

4.37 g/t Au and 11.3 g/t Ag over 1.20 m |

1.00 |

| LC20-278 |

16.50 |

17.80 |

1.30 |

5.90 |

12.2 |

11.71 g/t Au and 25.5 g/t Ag over 5.50 m |

5.00 |

| 17.80 |

18.80 |

1.00 |

16.10 |

44.0 |

| 18.80 |

19.50 |

0.70 |

22.10 |

70.7 |

| 19.50 |

20.50 |

1.00 |

7.45 |

8.1 |

| 20.50 |

21.25 |

0.75 |

19.30 |

20.7 |

| 21.25 |

22.00 |

0.75 |

4.36 |

10.0 |

| 26.00 |

27.00 |

1.00 |

1.83 |

4.4 |

1.83 g/t Au and 4.4 g/t Ag over 1.00 m |

0.80 |

| 39.00 |

40.00 |

1.00 |

2.29 |

2.4 |

2.29 g/t Au and 2.4 g/t Ag over 1.00 m |

1.00 |

| 42.30 |

42.80 |

0.50 |

58.00 |

73.0 |

58.00 g/t Au and 73.0 g/t Ag over 0.50 m |

0.50 |

| LC20-279 |

57.60 |

58.90 |

1.30 |

13.30 |

9.9 |

13.30 g/t Au and 9.9 g/t Ag over 1.30 m |

0.90 |

| LC20-280 |

11.00 |

12.00 |

1.00 |

1.08 |

2.3 |

28.21 g/t Au and 43.1 g/t Ag over 2.80 m |

2.70 |

| 12.00 |

12.80 |

0.80 |

81.00 |

87.3 |

| 12.80 |

13.80 |

1.00 |

13.10 |

48.5 |

| 17.90 |

18.90 |

1.00 |

1.73 |

2.4 |

1.73 g/t Au and 2.4 g/t Ag over 1.00 m |

1.00 |

| 18.90 |

20.90 |

2.00 |

|

|

Void |

|

| 20.90 |

22.00 |

1.10 |

5.58 |

8.7 |

5.58 g/t Au and 8.7 g/t Ag over 1.10 m |

1.00 |

| 23.20 |

24.20 |

1.00 |

2.23 |

8.2 |

2.23 g/t Au and 8.2 g/t Ag over 1.00 m |

1.00 |

The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 meter of internal dilution. *Widths are reported as drill core lengths. **Indicates use of metallic screening method for assays. ***True width is estimated from interpreted sections. Assays for all samples, even those below cut-off, within the 17.05 m (16.1 m true width) interval are shown for drill hole LC20-277.

Bayacun Zone Assay Results Reported in this Press Release Disturbed by Faulting

| Drill Hole |

From

(m) |

To

(m) |

Width

(m)* |

Au

(g/t) |

Ag

(g/t) |

Interval Averages |

| LC20-219 |

|

|

|

|

|

No significant results |

| LC20-221 |

|

|

|

|

|

No significant results |

| LC20-222 |

|

|

|

|

|

No significant results |

| LC20-225 |

|

|

|

|

|

No significant results |

| LC20-243 |

|

|

|

|

|

No significant results |

| LC20-268 |

32.00 |

33.50 |

1.50 |

1.27 |

0.5 |

1.27 g/t Au and 0.5 g/t Ag over 2.80 m |

| LC20-269 |

22.50 |

23.50 |

1.00 |

2.23 |

8.5 |

2.23 g/t Au and 8.5 g/t Ag over 1.00 m |

| LC20-270 |

|

|

|

|

|

No significant results |

| LC20-272 |

35.60 |

36.30 |

0.50 |

3.66 |

1.2 |

3.66 g/t Au and 1.2 g/t Ag over 0.50 m |

| LC20-273 |

|

|

|

|

|

No significant results |

The mineralized intervals shown above utilize a 1.0 g/t gold cut-off grade with not more than 1.0 meter of internal dilution. *Widths are reported as drill core lengths. True width is not estimated for intervals shown above.

Sampling, Assaying, QA/QC and Data Verification

Drill core was continuously sampled from inception to termination of the drill hole. Sample intervals were typically one meter. Drill core diameter was HQ (6.35 centimeters). Geologic and geotechnical data was captured into a digital database, core was photographed, then one-half split of the core was collected for analysis and one-half was retained in the core library. Samples were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas and pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. Gold was analyzed by standard fire assay fusion, 30-gram aliquot, AAS finish. Samples returning over 10.0 g/t gold are analyzed utilizing standard Fire Assay-Gravimetric method. Due to the presence of coarse gold, the Company has used 500-gram metallic screened gold assays for analyzing samples from mineralized veins and samples immediately above and below drilled veins. This method, which analyzes a larger sample, can be more precise in high-grade vein systems containing coarse gold. All reported drill results in this press release using the metallic screening method are indicated. The Company follows industry standards in its QA&QC procedures. Control samples consisting of duplicates, standards, and blanks were inserted into the sample stream at a ratio of 1 control sample per every 10 samples. Analytical results of control samples confirmed reliability of the assay data. No top cut has been applied to the reported assay results.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under National Instrument 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration firm. The Company is developing its high-grade San Albino gold project in Nueva Segovia, Nicaragua. Mako’s primary objective is to bring San Albino into production quickly and efficiently, while continuing exploration of prospective targets in Nicaragua.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Statements: Some of the statements contained herein may be considered “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is based on certain expectations and assumptions, including that: the goal of the 2020 drill program at Las Conchitas, being to focus on the most promising zones of near surface, shallow dipping, high-grade gold mineralization in order to delineate a maiden resource estimate, will ultimately be achieved; the assumption that the conceptual model will prove to be accurate; that additional drilling will support the current expectations of the Compamy;and that a maiden resource at the Las Conchitas may be delineated as a result of the Company’s 2020 drilling; Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, the risks that additional satisfactory exploration results at the Bayacun Zone will not be obtained; the risk that the Company’s drilling at Las Conchitas in 2020 will not delineate a maiden resource at the Las Conchitas area; that exploration results will not translate into the discovery of an economically viable deposit; risks and uncertainties relating to political risks involving the Company’s exploration and development of mineral properties interests; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations, the inability or failure to obtain adequate financing on a timely basis and other risks and uncertainties. Such information contained herein represents management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s plans and expectations at its San Albino project and the Las Conchitas area, and may not be appropriate for other purposes.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.