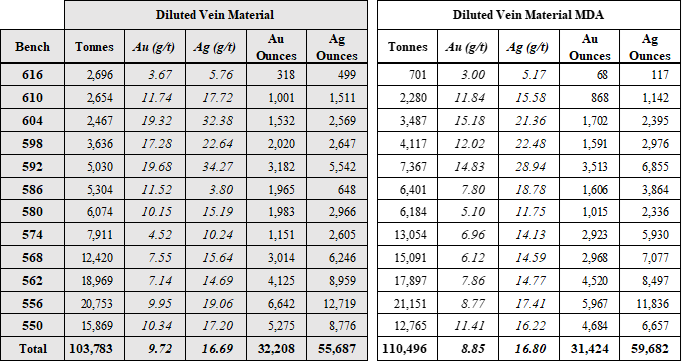

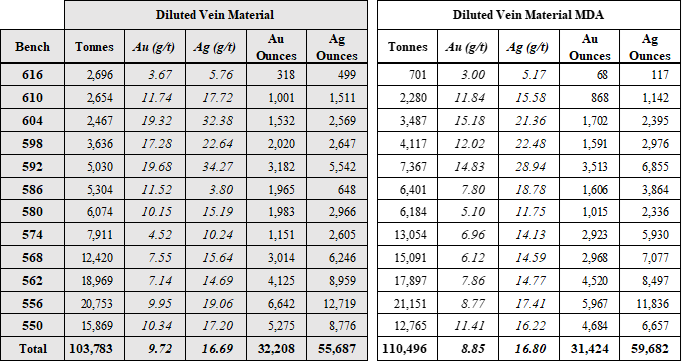

Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) (“Mako” or the “Company”) is pleased to report grade and tonnage results from mining the first 12 benches of the San Albino vein at its San Albino gold project (“San Albino”) in northern Nicaragua. The mined benches consisted of twelve, six-meter benches between 616 and 550 meters above sea level and contained a total of 32,208 ounces Au and 55,687 ounces Ag within 103,783 tonnes of diluted vein material grading 9.72 g/t Au and 16.69 g/t Ag.

The diluted vein material mined at San Albino thus far has positively reconciled on both grade and ounces by 10% and 2.5% respectively, to the mineral resource estimate prepared by Mine Development Associates (“MDA”), a division of RESPEC, out of Reno, Nevada. A technical report for the updated mineral resource estimate (the “MDA Resource”) was filed in accordance with National Instrument 43-101, Standards of Disclosure for Mineral Projects (“NI 43-101”) under the Company’s SEDAR profile at www.sedar.com and is also available on the Company’s website at www.makominingcorp.com (see press release dated October 19, 2020). In comparison, 110,496 tonnes at a grade of 8.85 g/t Au and 16.8 g/t Ag containing 31,424 ounces Au and 59,682 ounces Ag over the same 12 benches were modeled in the MDA Resource.

To date, areas mined in the MDA Resource contained 40% measured resources, 25% indicated resources and 35% inferred resources.

Akiba Leisman, Chief Executive Officer of Mako states that, “we are extremely happy with performance of the MDA Resource model thus far. Management and MDA intentionally used conservative assumptions to account for dilution in the resource model, so the 10% positive grade reconciliation is welcome news, but not a surprise. The information we have received from mining these twelve benches thus far have not only validated our geological model, but also, they are providing invaluable information to aid in the delineation of additional deposits at Las Conchitas and elsewhere on our 188 square kilometer district.”

Comparative Reconciliation (by bench)

Sampling, Assaying, QA/QC and Grade Estimation

Diluted vein material was estimated using vertical channel samples. Vertical channel samples respecting the geology were collected on 5-meter sections at approximately 4-meter spacing using a gas-powered rock saw where the vein is competent, or a rock hammer where the rock is strongly fractured or brecciated. Special attention is applied to standardize the width and volume of material taken using the rock hammer or rock saw. The coordinates of the channel samples are surveyed using a total station surveying device. Historical dump material estimation used blast hole data in addition to vertical channel samples. Continuous 3-meter samples over the 6m bench were collected from the blast holes using a sample collection pan that traps all the blast hole material. The entire sample is then split using a Gilson splitter.

Samples for the first 3.5 benches were kept in a secured logging and storage facility until such time that they were delivered to the Managua facilities of Bureau Veritas, an independent assay lab, for sample preparation. Pulps were sent to the Bureau Veritas laboratory in Vancouver for analysis. Gold was analyzed by standard fire assay fusion, 30-gram aliquot, Atomic Absorption Spectrometry (AAS) finish. Samples returning over 10.0 g/t Au are analyzed utilizing standard fire assay-gravimetric method. The Company follows industry standards in its quality assurance and quality control (“QA/QC”) procedures. Control samples consisting of duplicates, standards and blanks were inserted into the sample stream at a ratio of 1 control sample per every 3 to 4 samples. Analytical results of control samples confirmed reliability of the assay data.

Samples from benches 592 to 550 were sent directly to San Albino Mine’s on-site laboratory for preparation and assay. Gold was analyzed by standard fire assay fusion, 30-gram aliquot, with an AAS finish. The Company’s onsite lab follows industry standards in its quality assurance and quality control (“QA/QC”) procedures. The QA/QC program includes the blind insertion of certified reference standards and assay blanks at a frequency of at least 1 per 20 normal samples as well as the submission of field duplicates. In addition, approximately 10% duplicate samples are sent to the Bureau Veritas laboratory in Vancouver, an ISO 9001:2008 certified laboratory on a regular basis. Analytical results of control samples confirmed reliability of the assay data.

The grade of the diluted San Albino vein and historical dump material were estimated using the inverse distance squared method (“ID2”) from 1-meter composite intervals respecting the geologic boundaries. Samples were capped prior to compositing at 100 g/t Au in the San Albino vein, 7.0 g/t Au in the San Albino footwall, 4 g/t Au in the San Albino hanging wall and 25 g/t Au in the dump material. Capping values were based on analysis of previous diamond drilling results which were used in the MDA Resource. The search ellipse for the dump material was limited to 4 m for gold assays >2.5 g/t Au. The diluted grade of the San Albino vein for the first four benches was estimated using 3-D models of surveyed vein boundaries and surveyed mined surfaces where the vein boundaries were clearly defined. Within the Porcelana zone (benches 580-550), where the vein boundaries are diffuse due to fault stacking of the veins, the un-diluted grade of the San Albino vein was estimated using 3-D models derived from the surveyed channel samples defining the hanging wall, footwall, and vein boundaries. The diluted grade of the vein was estimated using daily tonnage estimates of the mined material.

Qualified Person

John M. Kowalchuk, P.Geo, a geologist and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Kowalchuk is a senior geologist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered “forward-looking information” within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company’s plans and certain expectations and assumptions, including that the information the Company has received from mining the twelve benches thus far will provide invaluable information to aid in the delineation of additional deposits at Las Conchitas and elsewhere on the 188 square kilometer district;and that the Company can operate San Albino profitably in order to fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, the risk that the information does not prove useful in delineating additional deposits on the Company’s land package; the Company’s failure to operate San Albino profitably and/or fund its exploration of prospectus targets on its district-scale land package; political risks and uncertainties involving the Company’s exploration properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company’s public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s expectations regarding the San Albino gold project, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.