Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) (“Mako” or the “Company”) is pleased to provide first quarter 2023 (“Q1 2023”) production results from its San Albino gold mine (“San Albino”) in northern Nicaragua, which is the seventh full quarter of production results since declaring commercial production on July 1, 2021. Financial results for Q1 2023, including detailed reporting of our operating costs, are expected to be released by the end of this month.

Q1 2023 Production Highlights

- 47,238 tonnes mined containing 8,072 ounces of gold (“oz Au”) at a blended grade of 5.32 grams per tonne gold (“g/t Au”) and 11,001 ounces of silver (“oz Ag”) at a grade of 7.24 grams per tonne silver (“g/t Ag”)

- 18,029 tonnes mined containing 5,611 oz Au at 9.68 g/t Au and 6,219 oz Ag at 10.73 g/t Ag from diluted vein material

- 29,210 tonnes mined containing 2,461 oz Au at 2.62 g/t Au and 4,782 oz Ag at 5.09 g/t Ag from historical dump and other mineralized material above cutoff grade (“historical dump + other”)

- 36.3:1 strip ratio overall which includes accelerated waste development of the Phase 3 in West Pit.

- 49,675 tonnes milled containing 10,119 oz Au at a blended grade of 6.34 g/t Au and 7,869 oz Ag at 4.93 g/t Ag

- 38% and 62% from diluted vein and historical dump and other, respectively

- 587 tonnes per day (“tpd”) milled at 94% availability

- Recoveries of 82.5% for gold in Q1 2023

- 144,315 tonnes in stockpile containing 8,563 oz Au at a blended grade of 1.85 g/t Au

- 8,374 oz Au Equiv. recovered and 8,820 oz Au. Equiv. sold during the quarter

Akiba Leisman, Chief Executive Officer of Mako states that, “in Q1 2023 the plant began consistently operating at 600 tonnes per day (“tpd”). The Company achieved this milestone of operating at 20% above nameplate capacity with no additional capital requirements. Q1 production was moderately lower than Q4 2022 as the Company transitioned from Phase 2 to Phase 3 Mining of the West Pit at San Albino. Mining the high-grade Phase 3 West Pit commenced at the end of April, and production will be further supplemented as Mako begins mining Las Conchitas later this month. A maiden resource at Las Conchitas is nearing completion and is now scheduled to be publicly released in early Q3.”

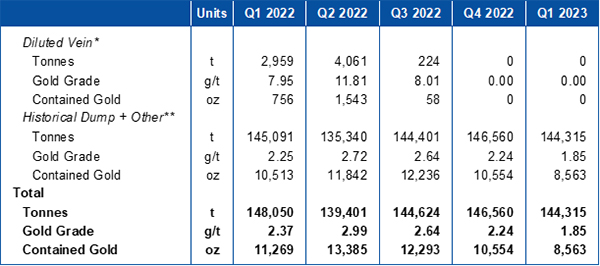

Table 1 – Production Results

* Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

**For the purpose of calculating revenue, payments to Sailfish are deducted from the Average Realized Price.

(1) Equiv. Gold ounces are calculated by: Silver Rec. or Silver Sold (oz) / Avg. Realized Price of Gold (US$/oz) / Avg. Realized Price of Silver (US$/oz)

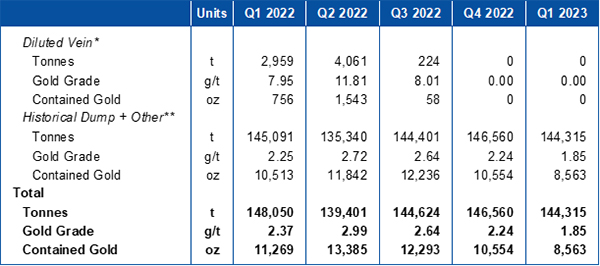

Table 2 – Quarter End Stockpile Statistics

* Includes stockpiles of mineralized material at the crusher.

** Includes historical dump, hanging wall, footwall, historical muck and all other non-vein mineralized material above cutoff grade.

Mining

The mine averaged 588 tpd of diluted vein and historical dump + other material in Q1 2023 with a strip ratio of 36.3 which included accelerated waste development of the Phase 3 in West Pit. The current stockpile is 144,315 tonnes containing 8,563 oz Au at 1.85 g/t Au.

Phase 2 mining of diluted vein material from the primary West Pit at San Albino concluded in February and was supplemented by diluted vein material coming from the Central and SW Pits during the quarter. Beginning in March, the Company focused on waste development for Phase 3 of the West Pit. Beginning the last week of April, mining the high-grade Phase 3 diluted vein material began, and permits to begin mining the initial Las Conchitas pits are expected imminently, which will also increase the amount of diluted vein material going forward.

The average grade of the diluted vein was 9.68 g/t Au during the quarter. A combination of geological mapping, additional lab testing, and new procedures implemented by our mine geologist have all contributed to improved mining selectivity, which limits the amount of preg-robbing material being fed to the plant, thereby enhancing recoveries. New blending processes allowed the mill to maintain high throughput without sacrificing recovery.

Lastly, initial development for a second waste dump began during the quarter with an initial capacity of 6 million tonnes (“Mt”) which can eventually be expanded to 23 Mt.

Milling

All components of the 500 tpd gravity and carbon-in-leach processing plant have been fully operational since the beginning of May 2021. During Q1, 2023, the plant has been averaging 587 tpd at 94% availability (see Table 1), including averaging 607 tonnes per day net of availability in March. In Q1 2023 the plant processed 38% diluted vein material and 62% historical dump + other material to achieve an average blended grade of 6.34 g/t Au. Gold recovery for the quarter was 82.5% (See Table 1). Due to the transition between Phase 2 and Phase 3 mining at the West Pit of San Albino, there was a relatively lower percentage of diluted vein material available compared to previous months. Now that high-grade diluted vein material from Phase 3 of the West Pit has commenced along with material coming from Las Conchitas later this month, the relative percentage of diluted vein material will revert towards historical norms of approximately 50%. This will lead to higher gold production levels beginning later this quarter.

The gold recovery in Q1 2023 was very close to the gold recovery during Q4 2022 despite the mill processing rate being 24 tpd higher and the gold head grade being 1.2 g/t lower than the previous quarter. 8,820 gold equivalent ounces (8,721 gold ounces) were sold in Q1 2023.

Qualified Person

John Rust, a metallurgical engineer and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

Corporate Update

Grant of RSUs and Options

The Company also announces the grant of 540,000 incentive stock options to certain directors, officers. Employees and/or consultants. The options will be exercisable, in whole or in part, at a price of $2.13 for a period of five years with vesting in 1/4 equal installments over a period of three years, with the first 25% vesting on the date of grant.

The Company also announces that as part of its incentive plans, it has granted 38,829 Restricted Stock Units (“RSUs) to officers of the Company. As such, the issuance of the RSUs to insiders is considered a related party transaction within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (“MI-61-101”). The Company relies on exemptions from the formal valuation and minority shareholder approval requirements provided under sections 5.5(a) and 5.7(a) of MI 61-101 on the basis that participation in the RSUs by insiders will not exceed 25% of the fair market value of the Company’s market capitalization. The Company will file a material change report in respect of the related party transaction in connection with the grant of RSUs.

On behalf of the Board,

Akiba Leisman

Chief Executive Officer

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Information: Statements contained herein, other than historical fact, may be considered “forward-looking information” within the meaning of applicable securities laws. The forward-looking information contained herein is based on the Company’s plans and certain expectations and assumptions, including that Q1, 2023 detailed operating costs and financial results will be available by the end of this month; the additional optimizations noted may improve recoveries further; and that the Company can operate San Albino profitably in order to fund exploration of prospective targets on its district-scale land package. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation; that the Company is not successful in operating San Albino profitably and/or funding its exploration of prospectus targets on its district-scale land package; political risks and uncertainties involving the Company’s exploration properties; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations and other risks and uncertainties as disclosed in the Company’s public disclosure filings on SEDAR at www.sedar.com. Such information contained herein represents management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s expectations regarding the Company’s Q1 2023 production results at San Albino gold project, and may not be appropriate for other purposes. Mako does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.