Mako Mining Corp. (TSX-V: MKO; OTCQX: MAKOF) (“Mako” or the “Company”) is pleased to provide the following operational and corporate updates:

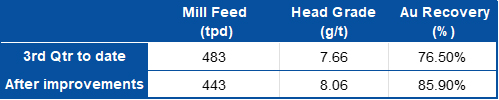

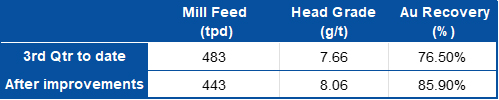

On July 20, 2022 the Company announced Q2 2022 production results showing recoveries of 74.5%, below the 86% recoveries announced in connection with its metallurgical testing from 2019 (see press release dated December 13, 2019). Beginning August 10, 2022 several mill improvements were implemented to improve metal recovery. Since this date, recoveries have been averaging 85.9%. The operational data for the quarter to date and for the portion of the quarter after improvements were implemented are set out in the table below:

Table 1: Recoveries

*Preliminary results based on information obtained through September 30th, 2022

The improvements implemented are listed below:

- Through selective mining procedures and blending protocols, the amount of preg-robbing material going through the mill was significantly reduced. The hanging wall and foot wall appears to have a much higher preg-robbing potential than the vein and weathered lithologies and our selective mining procedures were able to separate this material effectively

- The mill throughput was reduced from 544 tpd in July to 449 tpd in September in order to increase the leach retention time

- The lower mill throughput also resulted in a grind size improvement from 77.2% passing 75 microns to 79.1% passing 75 microns

- The measured free cyanide in the grinding circuit fell from 14.1 ppm to 2.1 ppm through improved operational procedures. The lower cyanide levels in the grinding circuit contributed to reduced losses through preg-robbing

- The inventory of carbon in the CIL circuit was increased from 25 to 34 tonnes

Further improvements anticipated in the coming months include:

- Resuming operation of the pre-leach thickener which will allow for a higher slurry density in the CIL, allowing for an increased throughput rate without sacrificing leach retention time

- Replacement of worn-out carbon retention screens to improve carbon loading efficiencies

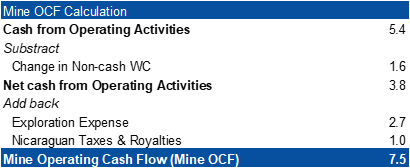

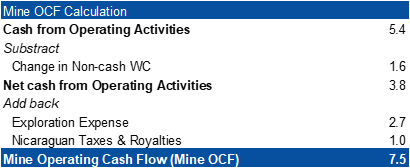

Akiba Leisman, CEO of Mako states that “the transition to carbonaceous fresh material from the oxide zone that we were mining in 2021 was a significant challenge for us to overcome. Nonetheless, our team’s quick and diligent response through a series of testing and improvements allowed us to get back to 85.9% recoveries since August 10th. We expect our recoveries to remain around this level in the future. It is worth mentioning that even with the diminution in recoveries experienced from March to early August 2022, San Albino generated US$7.5 million in Mine Operating Cash Flow1 (see press release dated August 16th, 2022) for Q2 2022, which allowed us to invest US$2.7 million in growth exploration and repay US$1.7 million in principal for the quarter to Wexford and Sailfish, albeit this was a lower principal repayment rate than would have been the case had recoveries been as expected.”

Non-GAAP Measures

The Company has included reference to Q2 2022 Mine Operating Cash Flow which is a non-GAAP financial measure. This non-GAAP measure is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. In the gold mining industry, this is a commonly used performance measure, but does not have any standardized meaning prescribed under IFRS and therefore may not be comparable to other issuers. The Company believes that, in addition to conventional measures prepared in accordance with IFRS, certain investors use this information to evaluate the Company’s underlying performance of its core operations and its ability to generate cash flow.

Mine Operating Cash Flow represents operating cash flow, excluding Nicaraguan taxes and royalties, changes in non-cash working capital and exploration expenses.

Qualified Person

John Rust, a metallurgical engineer, and qualified person (as defined under NI 43-101) has read and approved the technical information contained in this press release. Mr. Rust is a senior metallurgist and a consultant to the Company.

On behalf of the Board,

Akiba Leisman

CEO

About Mako

Mako Mining Corp. is a publicly listed gold mining, development and exploration company. The Company operates the high-grade San Albino gold mine in Nueva Segovia, Nicaragua, which ranks as one of the highest-grade open pit gold mines globally. Mako’s primary objective is to operate San Albino profitably and fund exploration of prospective targets on its district-scale land package.

For further information: Mako Mining Corp., Akiba Leisman, Chief Executive Officer, Telephone: 203-862-7059, E-mail: aleisman@makominingcorp.com or visit our website at www.makominingcorp.com and SEDAR www.sedar.com.

Forward-Looking Information

Statements contained herein that are not historical fact are considered “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is based on management’s current expectations, beliefs and assumptions, and includes, without limitation: expected results from mill improvements implemented to-date and those to be further implemented; and that the Company will meet its object of operating San Albino profitably while continuing to fund exploration of prospective targets. Such forward-looking information is subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those reflected in the forward-looking information, including, without limitation, that the mill improvements being implemented will not have the anticipated impacts; risks and uncertainties relating to political risks involving the Company’s exploration and development of mineral properties interests; the inherent uncertainty of cost estimates and the potential for unexpected costs and expense; commodity price fluctuations, the inability or failure to obtain adequate financing on a timely basis and other risks and uncertainties disclosed in the Company’s public filings at www.sedar.com. Forward-looking information contained herein is based on management’s best judgment as of the date hereof, based on information currently available and is included for the purposes of providing investors with the Company’s plans and expectations in connection with its business and operations, share and loan capital, and may not be appropriate for other purposes.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.